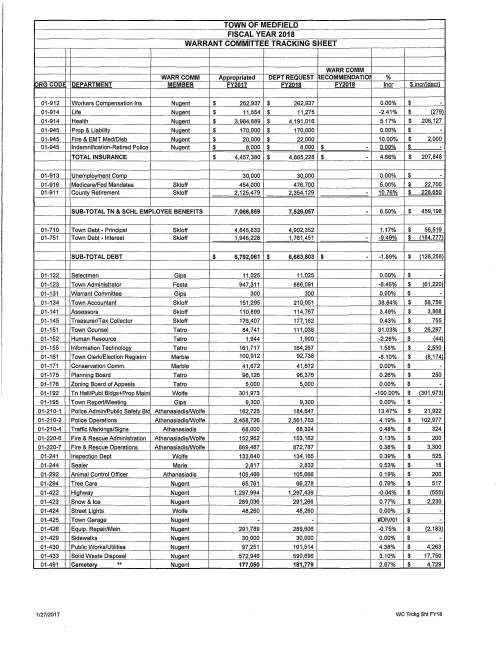

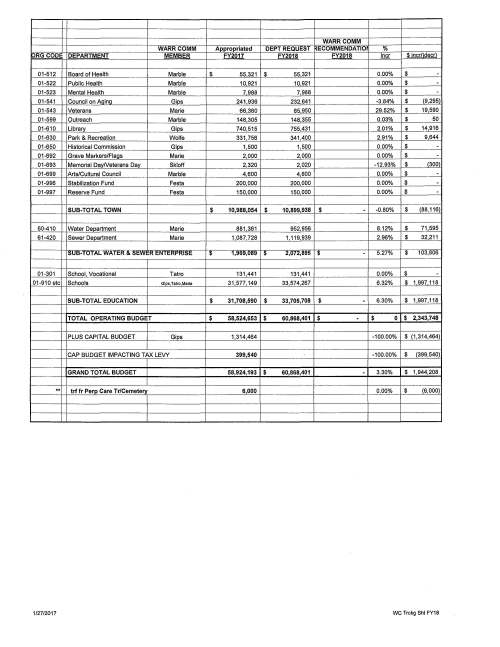

| GOV. BAKER FILES $40.5 BILLION FY 2018 BUDGET PROPOSAL

• UNRESTRICTED MUNICIPAL AID WOULD INCREASE BY $39.9 MILLION (3.9%)

• CHAPTER 70 AID WOULD INCREASE BY ONLY $91.4 MILLION (2%)

• MOST OTHER MUNICIPAL AND SCHOOL ACCOUNTS LEVEL-FUNDED

Earlier this afternoon, Gov. Charlie Baker submitted a $40.5 billion fiscal 2018 state budget plan with the Legislature, proposing a spending blueprint that would increase overall state expenditures by 4.3 percent, as the new Administration seeks to close an ongoing structural budget deficit by restraining spending across the board and placing an estimated $98 million into the state’s rainy day fund. The budget relies on $95 million in one-time revenues.

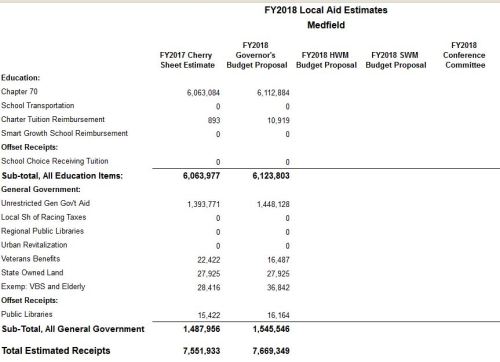

As Gov. Baker pledged to local officials on Jan. 21 at the MMA’s Annual Meeting, his budget includes a $39.9 million increase in Unrestricted General Government Aid, and $91.4 million more for Chapter 70 school aid. The Gov.’s proposal for Chapter 70 aid includes a minimum aid increase of $20-per- student, full funding of the foundation budget requirements, and continued implementation of the “target share” equity provisions. The foundation budget calculation would partially implement the Foundation Budget Review Commission’s recommendation to use a more realistic factor for the cost of employee health insurance in school systems.

Most other municipal and education aid accounts in the Governor’s budget proposal would remain at fiscal 2017 levels. This includes the special education circuit breaker, payments-in- lieu of taxes, regional school transportation, Shannon anti-gang grants, McKinney-Vento reimbursements and METCO funding.

The Governor would level-fund charter school reimbursements at $80.5 million, far below the amount necessary to fully fund the statutory formula that is designed to offset a portion of the amount that communities are required to transfer to charter schools. Level-funding this account would lead to the continued and growing diversion of Chapter 70 funds away from municipally operated school districts, and place greater strain on the districts that serve 96% of public school children.

• Click here to see the UGGA and Chapter 70 Aid amounts listed by community in the

Governor’s budget

• Click below to see the Division of Local Services preliminary fiscal 2018 Cherry Sheet

aid amounts for your community, based on the Governor’s proposed budget (you will

need to insert the name of your community in the field):

Municipal Aid

Regional School District Aid

• Click here to see DESE’s calculation of fiscal 2018 Chapter 70 aid and Net School

Spending requirements for your city, town, or regional school district, based on the

Governor’s proposed budget

UNRESTRICTED MUNICIPAL AID INCREASED BY $39.9 MILLION

In a major victory for cities and towns, House One (the Governor’s fiscal 2018 budget submission) would provide $1.062 billion for UGGA, a $39.9 million increase over current funding. This fulfills one of Gov. Baker’s major campaign promises to increase direct municipal aid by the same rate of growth as state tax revenues.

The $39.9 million would increase UGGA funding by 3.9 percent, the same rate of growth projected for state tax revenues. Every city and town would see their UGGA funding increase by this 3.9 percent growth rate.

CHAPTER 70 SCHOOL AID WOULD GO UP JUST 2 PERCENT

The Governor’s budget submission proposes a small 2 percent increase in Chapter 70 education aid of $91.4 million, providing every city, town and school district with a minimum increase of $20 per student. The Governor’s budget would continue to implement the target share provisions enacted in 2007. The overall Chapter 70 increase would be significantly smaller than in recent years. The Governor’s budget includes a partial reflection of one of the Foundation Budget Review Commission’s key recommendations, which is updating the foundation budget to reflect the cost of employee health insurance. But this adjustment in the foundation budget is not enough to increase aid to many districts. 237 cities and towns (74% of all operating districts) would only receive an increase of $20 per student under the Governor’s budget. This below-inflation increase is too low, and would force communities to reduce school programs or further shift funds from the municipal side of the budget.

Please ask your Legislators to support a funding increase for Chapter 70 school aid that ensures that all schools receive a suitable and appropriate increase in fiscal 2018, which the MMA believes should be at least $100 per student. The MMA also strongly supports implementation of all of the recommendations of the Foundation Budget Review Commission to update the Chapter 70 “foundation budget” minimum spending standards for special education and employee health insurance, and to add to the spending standard a measure of recognition for the cost of services for low-income, English Language Learner (ELL) and other students who would benefit from more intensive services. The Commission recommended phasing in the changes over a four-year period, a position the MMA supports as well. Increasing minimum aid and fixing the inadequacies in the foundation formula are essential.

It should also be noted that House One contains language that would continue to allow communities to count retiree health insurance toward their net school spending, but only if they have done so beginning when the school finance law first went into effect in 1994, or if they have previously voted to adopt the local-option provision in section 260 of the fiscal year 2015 general appropriations act to allow a phase-in of retiree health insurance costs in their net school spending calculation.

Further, House One would use the same methodology that was used in this year’s fiscal 2017 budget to estimate the number of low-income students used in the foundation budget calculation.

SPECIAL EDUCATION CIRCUIT BREAKER UNDERFUNDED

The Governor’s budget would level-fund the Special Education Circuit Breaker program at $277 million. Because special education costs are expected to rise in fiscal 2018, this means that the Governor’s budget likely underfunds reimbursements by as much as $10 million. This is a vital account that every city, town and school district relies on to fund state-mandated services. The Legislature has intended to fully fund the program for the past five years, and the MMA will again be asking lawmakers to ensure full funding in fiscal 2018.

CHARTER SCHOOL REIMBURSEMENTS LEVEL FUNDED AT $80.5 MILLION

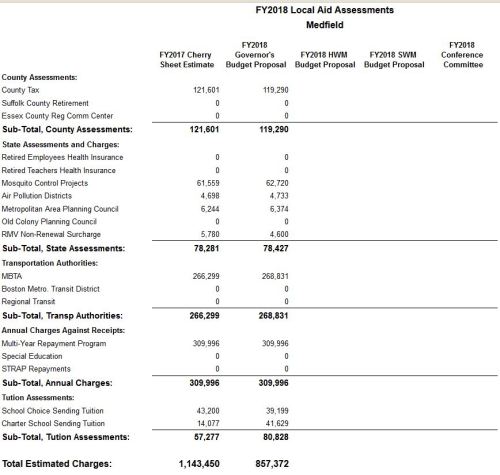

As noted above, the Governor would level-fund charter school reimbursements at $80.5 million, far below the amount necessary to fully fund the statutory formula that was originally established to offset a portion of the funding that communities are required to transfer to charter schools. The fiscal 2017 funding level is $54 million BELOW what is necessary to fund the reimbursement formula that is written into state law, so it is clear that the shortfall will grow significantly in fiscal 2018. Even though the reimbursement formula is level-funded at $80.5 million, the Governor’s fiscal 2018 budget would INCREASE charter school assessments by $60 million. This would lead to the continued and growing diversion of Chapter 70 funds away from municipally operated school districts, and place greater strain on the districts that serve 96% of public school children. Solving the charter school funding problem must be a major priority during the budget debate.

REGIONAL SCHOOL TRANSPORTATION REIMBURSEMENTS LEVEL FUNDED

Gov. Baker’s budget submission would level-fund regional transportation reimbursements at the $61 million amount. This will be a hardship for virtually all communities in regional districts. Reimbursements for transportation of out-of- district vocational students remains significantly underfunded at $250K. Increasing these accounts is a priority for cities and towns.

McKINNEY-VENTO REIMBURSEMENTS LEVEL FUNDED

The Governor’s budget would level-fund reimbursements for the transportation of homeless students at $8.35 million. The impact of this funding level will vary from community-to- community depending on the number of homeless families that remain sheltered in local hotels and motels. The Administration has been successful in reducing the number of homeless students who are dislocated from their original district, but those communities that continue to provide transportation to many students may continue to see shortfalls.

PAYMENTS-IN- LIEU-OF- TAXES (PILOT) AND SHANNON GRANTS LEVEL FUNDED, AND LIBRARY AID UP $189K

The Governor’s budget would level fund PILOT payments at $26.77 million, Shannon anti-gang grants at $6 million, and fund library grant programs at $19.07 million (up $189K).

GOV. PROPOSES APPLYING HOTEL-MOTEL TAX TO AIRBNB AND OTHER SHORT-TERM RENTALS, BUT ONLY IF RENTED FOR 150 DAYS

House One includes an outside section that would subject Airbnb and other short-term rentals to the local room occupancy excise tax. However, this would only apply in cases where the property is rented for 150 days or more. The MMA strongly supports extending the room occupancy excise to ALL short-term rentals. The 150-day threshold would continue to shield almost all seasonal and short-term rentals from taxation, and would not close the loophole that exists now.

GOV. PROPOSES FUNDS TO BEGIN PROCESS OF HAVING DEP TAKE THE LEAD IN OVERSEEING FEDERAL STORMWATER PERMITS

The Governor’s budget proposes $1.4 million to begin the process of having the Department of Environmental Protection assume “delegated authority” from the U.S. EPA to oversee the NPDES Stormwater Permit process (also referred to as MS4 permits). The MMA supports having DEP as the lead agency for stormwater permits. The $1.4 million would fund 12 DEP staff positions to begin the transition to becoming the lead agency. Full funding would take approximately $4.7 million. The Governor will be filing separate legislation to allow DEP to petition the EPA for this authority.

PLEASE CONTACT YOUR LEGISLATORS TODAY AND CALL ON THEM TO PUBLICLY SUPPORT THE GOVERNOR’S PROPOSAL TO INCREASE UNRESTRICTED MUNICIPAL AID BY $39.9 MILLION – THIS INCREASE IS VITAL TO LOCAL BUDGETS IN EVERY CORNER OF MASSACHUSETTS

AND PLEASE ASK YOUR LEGISLATORS TO COMMIT TO INCREASING CHAPTER 70 EDUCATION AID, FIXING THE FLAWS IN CHARTER SCHOOL FUNDING, AND FULLY FUNDING KEY MUNICIPAL AND SCHOOL PROGRAMS |