Tuesday, May 17, 2016

SENATE BUDGET COMMITTEE OFFERS $39.5B FY 2017 STATE BUDGET THAT MAKES KEY INVESTMENTS IN MUNICIPAL AND SCHOOL AID

• INCLUDES THE FULL $42M INCREASE IN UNRESTRICTED MUNICIPAL AID (UGGA)

• INCREASES CHAPTER 70 BY $44M ABOVE THE GOVERNOR’S BUDGET TO PROVIDE MINIMUM AID OF $55 PER STUDENT, INCREASE TARGET SHARE FUNDING, AND HELP ADDRESS THE LOW-INCOME STUDENT FACTOR

• ADDS $9.3M TO FULLY FUND THE SPECIAL EDUCATION CIRCUIT BREAKER

• LEVEL-FUNDS MOST OTHER MUNICIPAL AND SCHOOL ACCOUNTS

• BUT THE SW&M BUDGET CUTS $16.6M FROM KINDERGARTEN DEVELOPMENT GRANTS, WHICH WOULD CREATE SHORTFALLS IN 164 SCHOOL DISTRICTS

Earlier today, the Senate Ways and Means Committee reported out a tight $39.5 billion fiscal 2017 state budget plan to increase overall state expenditures by approximately 3.5 percent. The Senate Ways and Means budget is slightly smaller than the budget passed by the House in April and the version filed by the Governor in March, yet it would offer the largest increase in Chapter 70 aid. The full Senate will debate the fiscal 2017 state budget beginning on Tuesday, May 24.

S. 4, the Senate Ways & Means budget, provides strong progress on many important local aid priorities, including the full $42 million increase in Unrestricted General Government Aid that the Governor and House have agreed on. The SW&M Committee would increase funding for several major aid programs, by adding $9.3 million to the Special Education Circuit Breaker, increasing Chapter 70 minimum aid to $55 per student, and by adding funds in the Chapter 70 distribution to help address the low-income student calculation (the House budget has a separate $10 million reserve account for this issue), and to accelerate implementation of the so-called target share provisions in Chapter 70.

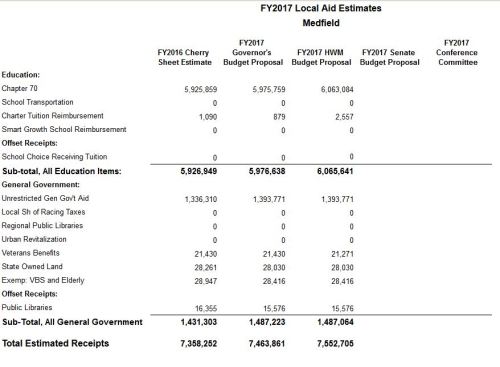

PLEASE CLICK HERE TO SEE YOUR COMMUNITY’S LOCAL AID AND PRELIMINARY CHERRY SHEET NUMBERS IN THE SENATE WAYS & MEANS BUDGET, AS ESTIMATED BY THE DIVISION OF LOCAL SERVICES

$42 MILLION INCREASE IN UNRESTRICTED MUNICIPAL AID

In a major victory for cities and towns, S. 4 (the SW&M fiscal 2017 budget plan) would provide $1.021 billion for UGGA, a $42 million increase over current funding – the same increase proposed by Governor Baker and the House of Representatives. The $42 million would increase UGGA funding by 4.3 percent, which matches the growth in state tax collections next year. This would be the largest increase in discretionary municipal aid in nearly a decade. Every city and town would see their UGGA funding increase by 4.3 percent.

CHAPTER 70 MINIMUM AID WOULD INCREASE TO $55 PER STUDENT

The Senate budget committee is proposing a $116 million increase in Chapter 70 education aid above fiscal 2016 levels, providing every city, town and school district with an increase of at least $55 per student. In addition to the minimum aid increase, which matches the House-passed level, the SW&M Committee would add additional funds to aid communities impacted by changes in the calculations used to account for low-income students. (The House included a $10 million reserve account for this issue instead of incorporating the funds into the Chapter 70 distribution). Further, the SW&M budget would accelerate the implementation of the 2007 target share provisions (the Senate proposal is to fund 85% of the target share goal, compared to the House’s 70% funding level). Overall, the SW&M budget would provide $44 million more in direct Chapter 70 distributions than the Governor’s budget, and $20 million more than the House (or $10 million more after recognizing the House’s $10 million reserve for low-income students).

$9.3 MILLION INCREASE INTENDED TO FULLY FUND SPECIAL EDUCATION CIRCUIT BREAKER

In another victory for cities and towns, Senate leaders have announced that they support full funding for the Special Education Circuit Breaker program. Their budget plan would provide $281.1 million, a $9.3 million increase above fiscal 2016, with the intention of fully funding the account. The Governor level funded the circuit-breaker program, and the House provided a $5 million increase. This is a vital program that every city, town and school district relies on to fund state-mandated services.

BUT THE SW&M BUDGET WOULD CUT $16.6 MILLION FROM KINDERGARTEN DEVELOPMENT GRANTS, AN 89% REDUCTION THAT WOULD HIT 164 DISTRICTS

In a troubling development, S. 4 would cut $16.6 million from Kindergarten Development Grants, leaving only $2 million in this program that funds Kindergarten programs in 164 school districts. The Governor and House level-funded the program at $18.6 million. Restoring these funds will be a major priority during the budget debate, and local officials will want to talk with their Senators about this program right away. Please click here to see if your community is receiving these grants in fiscal 2016. These funds are in jeopardy if the S. 4 appropriation remains in place.

FUNDING FOR CHARTER SCHOOL REIMBURSEMENTS INCREASED BY $7 MILLION, BUT STILL UNDERFUNDED

Under state law, cities and towns that host or send students to charter schools are entitled to be reimbursed for a portion of their lost Chapter 70 aid. The state fully funded the reimbursement program in fiscal years 2013 and 2014, but is underfunding reimbursements by approximately $46.5 million this year. The Senate Ways and Means budget would increase funding for charter school reimbursements to $87.5 million, a $7 million boost. This is $2 million more than the House proposed and $15 million less than the amount recommended by Gov. Baker. The program is underfunded in all three budget proposals, and increasing this account will be a top priority during the Senate budget debate.

REGIONAL SCHOOL TRANSPORTATION, PAYMENTS-IN-LIEU-OF-TAXES (PILOT), LIBRARY AID ACCOUNTS, METCO, McKINNEY-VENTO, AND SHANNON ANTI-GANG GRANTS

The Senate budget committee’s proposal would level-fund Regional School Transportation Reimbursements at $59 million ($1 million less than the House budget), level fund PILOT payments at $26.77 million (the same as the House and Governor), level-fund METCO at $20.1 million, and level-fund McKinney-Vento reimbursements at $8.35 million. S. 4 would fund library grant programs at $18.9 million ($70K less than fiscal 2016 and $750K less than the House). The SW&M budget would reduce Shannon Anti-Gang Grants to $5 million (a $2 million reduction below fiscal 2016, and $1 million below the House).

Please Call Your Senators Today to Thank Them for the Strong Municipal Aid and Chapter 70 Investments in the Senate Ways and Means Committee Budget, Including the $42 Million Increase in Unrestricted Local Aid, Providing Chapter 70 Minimum Aid at $55 Per Student, and Full Funding for the Special Education Circuit Breaker

Please Let Your Senators Know if You Are Affected by Underfunding in Charter School Reimbursements and Kindergarten Development Grants

Please Explain How the Senate Ways and Means Budget Impacts Your Community, and Ask Your Senators to Build on this Progress During Budget Debate in the Senate