These are the current drafts of the annual town meeting (ATM) warrant articles that have been proposed so far. The warrant for the ATM closes at the next the Board of Selectmen meeting, so be sure to get any warrant articles in right away.

DRAFT

TOWN OF MEDFIELD

WARRANT FOR THE ANNUAL TOWN MEETING

2017

On Monday, the twentieth-fourth day of April, A.D., 2017 commencing at 7:30 P.M. the following Articles will be acted on in the Amos Clark Kingsbury High School gymnasium, located at 88R South Street in said Medfield, viz

Article 2. To see if the Town will vote to accept the reports of the several Town Officers for the past year.

The reports are contained in the Annual Report, which is available at Town Meeting

WARRANT COMMITTEE RECOMMENDS PASSAGE

Article 3. To see if the Town will vote to accept the following named sums as Perpetual Trust Funds for the care of lots in the Vine Lake Cemetery, the interest thereof as may be necessary for said care, viz.

PERPETUAL CARE 2016

NAME AMOUNT

Sullivan, Robert E. $ 600.

Wilhelm, Nancy $ 750.

McNulty, James $3,000.

Kennally, Paul $3,000.

Baacke, Eric $1,500.

Baker, Fredrick P. $3,000.

Nagle, James F. $3,000.

Cote, Norman J. $ 750.

O’Donovan, Margaret M. $3,000.

Snipas, Norma R. $3,000.

Bratsos, Peter C. $ 750.

Tempel, Barbara S. $3,000.

Palladino, Peter $ 750.

Priest, Lisa M. $3,000.

Anselme, J.P. $ 750.

Anselme, J.P. $1,500.

Perrone, Roberta $1,500.

Scecina, Margaret $3,000.

O’Rourke, JoAnn $ 600.

Thompson, Diana $ 600.

Thompson, Diana $ 600.

MacLean, Mary $1,500.

Godin, Elizabeth M. $3,000.

Orvedahl, Donna S. $1,500.

Total $43,650.

Article 4. To see if the Town will vote to amend the Code of the Town of Medfield, (M Cerel will write up article for revolving funds) (add authorization of a State Hospital Revolving Fund instead of Hospital Stabilization Fund per Joy and Kris)

Article 5. To see if the Town will adopt the provisions of Mass G.L., Chapter 80, Section 13B, Sewer Betterment Deferral and Recovery Agreements for Seniors and of Mass G.L., Chapter 83, Section 16G, Deferral of Sewer User Charges for Seniors, or do or act anything in relation thereto.

(Board of Assessors)

Article 6. To see if the Town will vote to supplement each prior vote of the Town that authorizes the borrowing of money to pay costs of capital projects to provide that, in accordance with Mass G.L., Chapter 44, Section 20, the premium received by the Town upon the sale of any bonds or notes thereunder, less any such premium applied to the payment of the costs of issuance of such bonds or nots, may be applied to pay project costs and the amound authorized to be borrowed for each such project shall be reduce d by the amount of any such premium so applied, or do or act anything in relation thereto.

(Treasurer/Collector)

(majority vote)

Article 7. To see if the Town will vote to appropriate a sum of money and determine in what manner said sum shall be raised for the purpose of paying a fy17 unpaid medical bill of the Police Department in the amount of $1,495, or do or act anything in relation thereto.

(Chief of Police)

(four-fifths vote required)

Article 8. To see if the Town will vote to appropriate an additional sum of money to the fy17 Reserve Fund, 01-997-2, or do or act anything in relation thereto.

(Warrant Committee)

Article 9. To see if the Town will vote to appropriate $70,000 from the Ambulance Revolving Fund, said funds to reimburse the General Fund Stabilization Fund for a temporary loan from said Stabilization Fund in fy17, to cover the purchase of a replacement ambulance for the Medfield Fire Department, or do or act anything in relation thereto.

(Town Administrator)

(Two-thirds vote required)

Article 10. To see if the Town will vote to fix the salary and compensation of the following elected officers: Moderator, Town Clerk, Selectmen, Assessors, School Committee, Trustees of the Public Library, Park and Recreation Commissioners, Planning Board, Housing Authority and Trust Fund Commissioners, or do or act anything in relation thereto.

Officer

|

Present Salary

|

W.C. Recommends

|

| Town Clerk |

$68,000 |

$ ,000 |

| Selectmen, Chairman |

900 |

900 |

| Selectmen, Clerk |

900 |

900 |

| Selectmen, Third Member |

900 |

900 |

| Assessors, Chairman |

900 |

900 |

| Assessors, Clerk |

900 |

900 |

| Assessors, Third Member |

900 |

900 |

| Moderator |

0 |

0 |

| Housing Authority |

0 |

0 |

| School Committee |

0 |

0 |

| Library Trustees |

0 |

0 |

| Planning Board |

0 |

0 |

| Park & Recreation Commissioner |

0 |

0 |

| Trust Fund Commissioner |

0 |

0

|

(Board of Selectmen)

Section 9.3 of the Town Charter reads as follows: “Elected officers shall be compensated in an amount authorized by Town Meeting and provided for by a Town Meeting Appropriation”.

Article 11. To see if the Town will vote to amend the PERSONNEL ADMINISTRATION PLAN and CLASSIFICATION OF POSITIONS AND PAY SCHEDULE, effective July 1, 2017, as set out in the warrant, or do or act anything in relation thereto.

(Personnel Board)

Article 12. To see if the Town will vote to raise and appropriate and/or transfer from available funds sums of money requested by the Selectmen or any other Town Officer, Board, Commission or Committee to defray operating expenses of the Town for the fiscal year commencing July 1, 2017, or such other sums as the Town may determine, as required by General Laws, Chapter 41, Section 108, or do or act anything in relation thereto.

(Board of Selectmen)

Article 13. To see if the Town will vote to raise and appropriate from the Fiscal 2018 Tax Levy and or transfer from available funds and/or borrow for Capital Expenditures, including the following:

| FY18 CAPITAL BUDGET |

| RECOMMENDATIONS |

| |

|

|

| DEPARTMENT |

PROJECT |

REQUEST |

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

|

|

(Capital Budget Committee)

Article 14. To see if the Town will vote to Amend the Code of Medfield Regulation by adding a new section establishing the Medfield Affordable Housing Trust and authorize the Trust to accept funds from the Medfield Community Development Corporation, or do or act anything in relation thereto. (Kris will forward wording of article)

(Board of Selectmen)

Article 15. To see if the Town will vote to appropriate a sum of money and determine in what manner said sum shall be raised for the purpose of providing ongoing maintenance and security at the site of the former state hospital, or do or take any action in relation thereto.

(Board of Selectmen)

Article 16. To see if the Town will vote to appropriate a sum of money and determine in what manner said sum shall be raised for the purpose of hiring consultants, engineers and/or attorneys to assist the Town with ongoing preparation of a master plan for reuse of the former hospital and surrounding areas and to advise the Town on matters concerning the site’s disposition, reuse and environmental remediation, said funds to be expended under the direction of the Board of Selectmen, with the understanding that the Board of Selectmen may authorize any other Town board, commission, committee or department to expend a portion of said funds for such purposes, or do or act anything in relation thereto.

(Board of Selectmen)

Article 17. To see if the Town will vote to authorize the Board of Selectmen to lease space on the Hospital Water Tower for the location of cellular antennae, or do or act anything in relation thereto.

(Board of Selectmen)

Article 18. To see if the Town will vote to appropriate a sum of money and determine in what manner said sum shall be raised for the purpose of making improvements to the downtown, or do or act anything in relation thereto.

(Board of Selectmen)

Article 19. To see if the Town will vote to transfer $163.549 from sewer betterments paid-in-advance to the Sewer Stabilization Fund, established under Article 31 of the 2004 ATM in accordance with the provisions of G.L., Chapter 40, Section 5B as amended by Chapter 46 of the Acts of 2003, or do or act anything in relation thereto.

(Town Accountant)

Article 20. To see of the Town will vote to transfer $41,299 from the fy17 County Retirement Contribution Budget, account 01-911-2, to the Other Post-Employment Benefits (OPEB) Trust, and appropriate to said Trust from the fy18 tax levy, free cash or other sources, such other sum(s), as the Town deems appropriate for the purpose of setting aside monies to cover the unfunded retiree health insurance costs in accordance with the provisions of G.L., Chapter 40 Section 5B, or do or act anything in relation thereto. ???? Is this the correct chapter now that we have a Trust instead of a Stabilization Fund?

(Town Administrator)

Article 21. To see if the Town will vote to increase the maximum annual payment under the senior tax work-off program from $500 to $1,000 or do or act anything in relation thereto.

(Council on Aging)

Article 22. To hear the report of the Senior Housing Study Committee, appointed under Article 38 of the 21016 Annual Town Meeting, and to see if the Town will appropriate a sum of money and determine how said sum shall be raised for the purposes of implementing the recommendations of its reports, and to see if the Town will transfer the care custody and control of a 9.1 acre parcel of land identified on the Board of Assessors’ maps as Lot 1, Map 64 to provide for the construction of appropriate moderate priced housing for Medfield Seniors, who would like to remain in the Town, or do or act anything in relation thereto.

(Senior Housing Study Committee)

Article 23. To see if the Town will vote to accept as a public way a portion of the following street:

Vinald Road from Station to Station

As laid out by the Board of Selectmen and as shown on a plan referred to in the Order of Layout on file with the Town Clerk’s office and to authorize the Board of Selectmen to acquire by eminent domain or otherwise, such rights, titles and easements, including drainage easements, as may be necessary to accomplish such purposes, or do or act anything in relation thereto.

(Planning Board)

Article 24. To see if the Town will vote to name the bridge crossing Mill Brook at Elm Street the “Colonel Douglas C. MacKeachie Bridge, and to appropriate a sum of money to fund a sign designating this bridge as such and to fund appropriate ceremonies in recognition of the occasion, or do or act anything in relation thereto.

(Committee to Study Memorials)

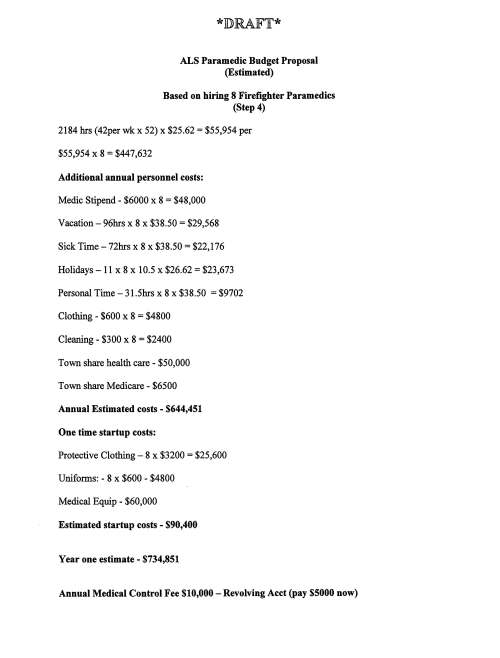

Article 25. To see if the Town will vote to appropriate a sum of money and determine in what manner said sum shall be raised for the purpose of hiring, training and equipping Advanced Life Support employees and/or contracting with a private firm to provide such services, provided that all appropriations authorized under this article be contingent upon approval of a so-called Proposition 2½ operating override in accordance with Chapter 59, Section 21C of the General Laws of the Commonwealth of Massachusetts, or do or act anything in relation thereto.

(Fire Chief Board of Selectmen or Citizen petition???)

(Citizen Petition)

Article 26 To see if the Town will vote to appropriate $1 million and determine in what manner said sum shall be raised for the purpose of acquiring land and/or property, designing and/or constructing a group home within the Town, said sum to be expended under the jurisdiction of the Medfield Affordable Housing Trust; and to authorize the Treasurer/Collector, with the approval of the Board of Selectmen, to borrow in accordance with the provisions of Mass G.L., Chapter 44, Section7, Paragraph 3 or such other authorizing statute as may be appropriate, and to authorize the Medfield Affordable Housing Trust to expend said funds, to enter into contracts with federal, state and/or private parties, and to apply for and accept federal, state and/or private grants to accomplish said purposes, provided that all appropriations authorized under this article be contingent upon approval of a so-called Proposition 2 ½ debt exclusion, in accordance with chapter 59, Section 21C of the General Laws of the Commonwealth of Massachusetts, or do or act anything in relation thereto.

(Citizen Petition)

Article 27. To see if the Town will vote to appropriate $10,000 for the purpose of making repairs and improvements to the Dwight-Derby House, said sum to be expended under the direction of the Facilities Manager, in consultation with the Friends of the Dwight-Derby House, Inc., or do or take anything in relation thereto.

(Citizen Petition)

Article 28. To see if the Town will vote to appropriate a sum money for the purpose of purchasing environmental liability insurance and/or constructing a rail trail on an unused rail bed leased to the Rail Trail, running from Ice House Road to the Dover town line, or do or take anything in relation thereto.

(Medfield Rail Trail Committee)

Article 29. To see if the Town will vote to purchase the existing the street lights, brackets and other associated fixtures and equipment located in the public ways of the Town from Boston Edison, Co. and to appropriate a sum of money for said purchase and for the purchase and installation of LED streetlights, said lights, brackets and other associated fixtures and equipment, to be owned and maintained by the Town of Medfield, and further, to authorize the Board of Selectmen to enter into a contract/contracts with Boston Edison, Eversource, or their successor entities; and to enter into contracts and to accept grants, loans or gifts from private contractors, state, federal and or private parties to accomplish said purposes and to effectuate the transfer of ownership, or do or take anything in relation thereto.

(Medfield Energy Committee)

Article 30. To see if the Town will vote to appropriate a sum of money and determine in what manner said sum shall be raised for the design and construction of a Park & Recreation Facility, including the hiring of a project manager and architect(s), preparation of construction plans and bid documents, site work, landscaping and utilities, and to authorize the Treasurer/Collector, with the approval of the Board of Selectmen, to borrow in accordance with the provisions of Mass G.L., Chapter 44, Section7, Paragraph 3 or such other authorizing statute as may be appropriate, and to authorize the Permanent Planning and Building Committee to expend said funds, to enter into contracts with federal, state and/or private parties, and to apply for and accept federal, state and/or private grants to accomplish said purposes, provided that all appropriations authorized under this article be contingent upon approval of a so-called Proposition 2 ½ debt exclusion, in accordance with chapter 59, Section 21C of the General Laws of the Commonwealth of Massachusetts, or do or act anything in relation thereto.

(Park & Recreation Commission)

Article 31. To see if the Town will vote to amend the Code of the Town of Medfield Division 2: Regulations, 270 Water, by adding a new section , , which would authorize the Medfield Water and Sewerage Commissioners and/or their designees to enter upon private property for the purpose of inspecting, installing, repairing, replacing or upgrading water meters and to establish procedures, timelines and or penalties to inform and assist property owners in accomplishing these tasks, said bylaw to read as follows:

(Mark Cerel will prepare. Will Check with Water & Sewerage Commission to see if it wants to put on warrant).

, or do or act anything in relation thereto.

(Water & Sewerage Commissioners)

Article 32. To see if the Town will vote to amend the Code of the Town of Medfield, 2: Regulations, 270 Water, by adding a new section , , which would Regulations by adding a new section , which would authorize Medfield Water and Sewerage Commissioners to implement water restriction regulations, and to establish measures and/or fines non-compliance, for the purpose of placing private, semi-private and or public water wells under the same restrictions as other public water customers of the Town of Medfield Water Department, said bylaw to read as follows:

(Mark Cerel will prepare. Will Check with Water & Sewerage Commission to see if it wants to put on warrant).

, or do or act anything in relation thereto.

(Water & Sewerage Commissioners)

Article 33. To see if the Town will vote to appropriate a sum of money, said sum to be transferred from the Water Enterprise Fund, Unreserved Fund Balance, for the purpose of designing an Iron/Manganese Treatment facility for wells three, four and/or five of the Town’s water supply system and preparing construction plans and bid documents for such, or do or act anything in relation thereto.

(Water & Sewerage Commissioners)

Article 34. To see if the Town will amend the Code of the Town of Medfield Division 1: Bylaws, Part II General Legislation, Regulations, by adding the following sections:

Illicit discharge Detection & Elimination (IDDE)

Construction/Erosion and Sediment Control

Post-Construction Stormwater Management

In order to achieve compliance with the 2003 National Polluant Discharge and

Emissions System (NPDES) 2003 General Permit.

(Director of Public Works)

(Moe will provide wording)

Article 35. To see if the Town will appropriate the sum of $5,000 for the purpose of trapping beavers and removing beaver dams throughout the Town, said sum to be expended under the jurisdiction of the Town Administrator, or do or act anything in relation thereto.

(Town Administrator)

Article 36. To see if the Town will amend the Code of the Town of Medfield Division 1: Bylaws, Part II General Legislation, 300 Zoning to provide for inclusionary Zoning (Mark Cerel & Sarah Raposa working on)

Articles 37. through 39. To see if the Town will amend the Code of the Town of Medfield, Division 1: Bylaws, Part II General Legislation, 300 Zoning to:

- Mitigate the impact of large single-family structures

- Mitigate the impact of large two-story structures

- Mitigate the impact of large multi-story structures

Article 40. To see if the Town will amend the Code of the Town of Medfield, Division 1: Bylaws, Part II General Legislation, 300 Zoning to amend the Tale of Area Regulation to provide for retail sales of recreational marijuana (Mark Cerel & Sarah Raposa working on).

Article41. To see if the Town will amend the Code of the Town of Medfield, Division 1: Bylaws, Part II General Legislation, 300 Zoning to add a new section regulating and/or taxing recreational marijuana. (Mark Cerel & Sarah Raposa working on).

Article 42. To see if the Town will vote to amend to Code of the Town of Medfield, Division 1: Bylaws, Part II General Legislation, 300 Zoning to add a new section Temporary Moratorium on the Sale and Distribution of Recreationl Marijuana, effective from May 1, 2017through June 30, 2018. (What about manufacture or growing?) (Carol Read Mark Cerel?).

Article 43. To see if the Town will vote to appropriate a sum of money for the purpose of preparing a Phase II Parking Study, said funds to be expended under the direction of the Economic Development Committee, and that said Committee be authorized to apply for and accept grants, loans or gifts from the state and federal government or private agencies and to enter into contracts with such, or do or act anything in relation thereto.

(Economic Development Committee)

Article 44. To see if the Town will vote to appropriate a sum of money and determine in what manner said sum shall be raised for the purpose of making improvements to the traffic flow at the intersections of Spring and South Streets and South and High Streets, said funds to be expended under the direction of the Board of Selectmen and that Selectmen be authorized to apply for and accept grants, loans or gifts from the state and federal government or private agencies and to enter into contracts with such, or do or act anything in relation thereto.

(Board of Selectmen)

Article 45. To see if the Town will vote to accept as public ways all or a portion of the following streets:

Quarry Road from Station 8+88.09 to Station 16+97.87

Erik Road from Station 0+00.00 to Station 9+00.00

As laid out by the Board of Selectmen and as shown on a plan referred to in the Order of Layout on file with the Town Clerk’s office and to authorize the Board of Selectmen to acquire by eminent domain or otherwise, such rights, titles and easements, including drainage easements, as may be necessary to accomplish such purposes, or do or act anything in relation thereto.

(Board of Selectmen)

Article 46. To see if the Town will authorize the board of Assessors to use a sum of money from free cash in the Treasury for the reduction of the tax rate for the fiscal year 2018, or do or act anything in relation thereto.

(Board of Assessors)

![*]])RAJF'Ir* ALS Paramedic Budget Proposal (Estimated) Based on hiring 8 Firefighter Paramedics (Step 4) 2184 hrs (42per wk x 52) x $25.62 = $55,954 per $55,954 x 8 = $44 7 ,632 Additional annual personnel costs: Medic Stipend - $6000 x 8 = $48,000 Vacation-96hrs x 8 x $38.50 = $29,568 Sick Time-72hrs x 8 x $38.50 = $22,176 Holidays-11x8 x 10.5 x $26.62 = $23,673 Personal Time - 31.5hrs x 8 x $38.50 = $9702 Clothing - $600 x 8 = $4800 Cleaning - $300 x 8 = $2400 Town share health care - $50,000 Town share Medicare - $6500 Annual Estimated costs - $644,451 One time startup costs: Protective Clothing- 8 x $3200 = $25,600 Uniforms: - 8 x $600 - $4800 Medical Equip - $60,000 Estimated startup costs - $90,400 Year one estimate - $734,851 Annual Medical Control Fee $10,000 - Revolving Acct (pay $5000 now)](https://medfield02052.blog/wp-content/uploads/2016/12/20161221-chief-kingsbury-als-paramedic-budget-proposal.jpg?w=500)