Photo by Phil Tuths

Email today from the Medfield State Hospital Master Planning Committee –

|

|

|

|

|

Photo by Phil Tuths

Email today from the Medfield State Hospital Master Planning Committee –

|

|

|

|

|

Posted in Development, Medfield State Hospital, Planning

Email today from the Board of Health –

the state has upgraded the ENTIRE state to the “moderate” level due to increase in activity re: WNV exposure.

———- Forwarded message ———-

From: Officer, MRPC Duty <mrpcdutyofficer@challiance.org>

Date: Tue, Aug 21, 2018 at 12:08 PM

Subject: Situational Awareness: Statewide West Nile Virus Risk Level Change

To:

To: MRPC Stakeholders

Date: Tuesday, August 21, 2018

Time: 12pm

Subject: Statewide West Nile Virus Risk Level Change

Description: MDPH has elevated the West Nile virus risk level to moderate statewide. This wide-scale increase was driven by expanding and intensifying positive mosquito findings. A press release will be issued shortly. The majority of WNV human cases occur during August and September. Please take this opportunity to urge your residents/patients to take personal protective activities to avoid mosquito bites. Please visit results: http://www.mosquitoresults.com for updated risk maps and positive findings. If you have questions please call Matt Osborne at (617) 983-4366.

Regional Impact: Multiple communities across Region 4AB have a moderate risk for West Nile Virus exposure according to http://www.mosquitoresults.com, the Massachusetts Arbovirus daily update provided by the Massachusetts Executive Office of Health and Human Services

MRPC Activation Level: Steady-State Monitoring, non-activated.

Follow up: The MRPC will continue to monitor the State’s West Nile Virus severity in the region and will provide updates from the Massachusetts Department of Public Health as they become available.

Attachments: None.

MRPC Duty Officer

Pager: (857)-239-0662

Email: mrpcdutyofficer@challiance.org (not monitored 24/7)

Today I got this email follow up, below, from the developer that the Medfield Housing Authority selected for the proposed project on Medfield Housing Authority land next to Tilden Village. I also met with the Legion and its developers this week about their plans, and the issue of how their timing fits in to the town’s safe harbor needs, so I asked Brain McMillin about the timing of his plan, and he reported “it’s not out of the question that it could take until 2022 or 2023 until these units are ready to be leased up.” –

I should probably point out that The Rosebay at Medfield is not public housing, so it is technically not an expansion of Tilden Village. It will be a privately-owned development located on land leased from the Medfield Housing Authority under a long-term ground lease.

Although it will not be public housing like Tilden Village, all of the units in the proposed development would still be affordable and age-restricted (62+) to meet the Housing Authority’s requirements. For the Town of Medfield, all 45 of the proposed units would count toward its Chapter 40B Subsidized Housing Inventory and further goals stated under its Housing Production Plan.

The basic structure we have proposed is fairly common and has been used around the country for privately-owned developments built on housing authority land. We are aware, however, that that it may require some explanation and we plan to provide that detail during our Comprehensive Permit hearing before the Zoning Board.

Regards,

Brian J. McMillin | NewGate Housing LLC

Comments Off on The Rosebay at Medfield

Posted in Affordable housing / 40B, Buildings, Development, Downtown, Seniors

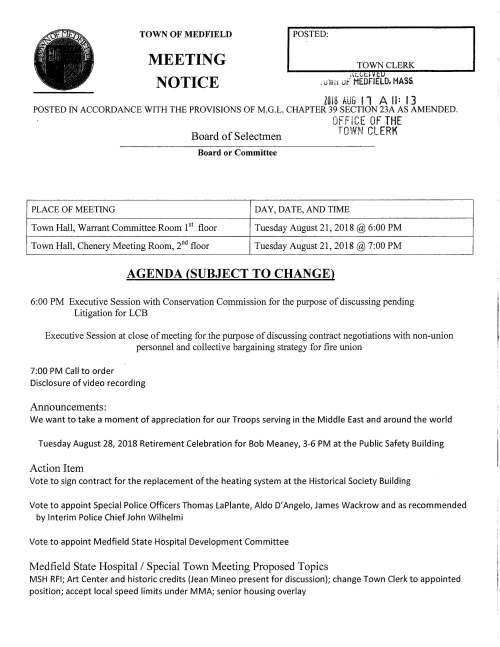

This link goes to the agenda and backup materials 20180821-agenda&materials

Comments Off on BoS on 8/21

Posted in Select Board matters

This email yesterday from Sarah Raposa about the Medfield Housing Authority’s planned expansion adjacent to its Tilden Village site having taken its first step by means of a filing with the Department of Housing and Community Development –

===========================================================

We haven’t received the hard copy from DHCD but Mike was cc’d on the submission to DHCD.

Here is the link to the application on the Town’s website:

http://ma-medfield.civicplus.com/CivicAlerts.aspx?AID=59

Best, Sarah

Sarah Raposa, AICP

Town Planner

===========================================================

The developer, Brian McMillin of NewGate Housing LLC, Westwood, MA stated to me that while the plans are “available on the Town’s website. . . they are a required step in preparing to file for a Comprehensive Permit for The Rosebay at Medfield, and they contain only basic preliminary information. More detailed information regarding the proposed development will be provided in the Comprehensive Permit application.”

Posted in Affordable housing / 40B, Development, Downtown, Seniors

The clock is ticking – today is the last day to register to vote before the September 4th primary in Massachusetts. So if it’s been sitting on your to-do list, it’s time to get it done!

Remember: you can register to vote online right here.

And if you or your friends are registering by mail, it’s not too late to send as long as it gets postmarked today.

Primary day is less than 3 weeks away – so make a plan to vote!

Comments Off on Today = last day to register for the 9/4 primary

Posted in Elections

Email from Kristine Trierweiler yesterday afternoon –

—

Assistant Town Administrator

Town of Medfield

Comments Off on Town House Phone System

Posted in Town Services

In case you have not seen the Medfield Press recently, Mike Gleason is one of the best reporters to ever cover the town. He is journalist who understands the stories he covers and he gets the facts right. It is truly refreshing to have a high quality journalist covering Medfield. If you subscribe you can read his 2-3 bylines for $1 a week.

MEDFIELD – A local effort to help needy children attend summer camp raised more than $5,000 this summer.

The initiative – organized by the Medfield Foundation – is now in its second year, said foundation member Osler Peterson. With the funds raised through the program, a total of 18 local children were able to attend 28 weeks of the camp put on by the Medfield Parks & Recreation Department. The money also allowed for nine additional swim pond passes, which gave about 34 people access to the pond.

Peterson said Medfield Youth Outreach leaders had first raised the matter with the foundation in 2017, as that group interacts quite a bit with people in need.

“Kids going to camp is not just about a fun time for the children,” he said. “It also allows parents to go to work.”

However, the idea was first discussed in June, forcing the foundation to move quickly to raise its $5,000 goal.

“We started it at the eleventh hour,” Peterson. “There was sort of a blitz to get information out on social media.”

This year, the drive was greatly bolstered by a $5,000 grant from the Medfield Home Committee.

“The Home Committee was impressed by the Medfield Foundation’s Camp Fund during its initial year last summer,” Committee Chairwoman Kathy Thompson said in a statement. “This year, the Home Committee wanted to support such a great, local goal for Medfield kids.”

Though the Home Committee provided the bulk of the money raised, the foundation was able to garner about $1,000 from other community donations, Peterson said. Those who wish to contribute to the drive may do so at the foundation’s website, www.medfieldfoundation.org, or by mailing checks to the group, care of the Medfield Town House.

The Medfield Foundation itself, Peterson said, grew out of a desire to bolster private philanthropy in town. Under its aegis, there have been efforts to provide a new football field for the high school and build an outdoor classroom for the Dale Street School, among other projects.

Mike Gleason can be reached at 508-316-2809 or mgleason@wickedlocal.com. For news throughout the day, follow him on Twitter@MGleason_MDN.

Comments Off on Medfield Press article on the Medfield Foundation Camp Fund

Posted in Charity, Children, Information, Medfield Foundation

This comes from the newsletter that I get from the Division of Local Services (DLS) at the DOR –

Discussing Community Preservation

Jared Curtis – Bureau of Accounts Field Representative

Tony Rassias – Bureau of Accounts Deputy Director

Each year, the Bureau of Accounts distributes a Budget Bulletin in the spring addressing issues that cities, towns, regional school and other districts should consider for the upcoming fiscal year’s revenue and expenditure budgeting and other related matters.

One particular topic that appears annually in the Bulletin and always generates inquiries is the Community Preservation Act (CPA) as it relates to state matching funds estimate for cities and towns. The following represents a discussion between Tony Rassias, Deputy Director of the Bureau of Accounts, and Jared Curtis, the Bureau’s subject matter expert, covers a variety of topics related to the CPA. We hope you find it helpful.

Tony Rassias: Jared, for cities and towns that haven’t accepted the CPA, could you first explain what the Act is all about?

Jared Curtis: Sure. Cities and towns that accept the CPA impose a surcharge on each parcel of taxable real estate up to an additional 3% of the bill, less any exemption to the surcharge adopted by the city or town as allowed by the CPA law. Total surcharges received are then reserved into a local CPA fund for community preservation purposes to preserve open space and historic resources, create affordable housing and develop outdoor recreational facilities. A state trust fund, created from recording fees at the Registry of Deeds and Land Court, provides an additional source of revenue to the local CPA fund through state matching funds.

TR: How do cities and towns accept the Act?

JC: Cities and towns have two acceptance options. Under the first option, the CPA is accepted under M.G.L. c. 44B, §3(b) and a surcharge up to 3% of the tax assessed on each parcel of taxable real estate is approved. This is called the “traditional” CPA. Under the second option, the CPA is accepted under G.L. c. 44B, § 3(b1/2) and (1) a surcharge of at least 1% is approved and (2) an appropriation of other municipal revenue is made into the Community Preservation Fund (CPF) which when added together with the surcharge will not exceed 3% of the taxes assessed on real property. This is called the “blended” CPA.

If a city or town has adopted a “traditional” CPA, it must follow the amendment procedure under M.G.L. c. 44B, § 16(a) to adopt the “blended” CPA. Adoption of the CPA under both options requires either (1) legislative body approval and voter approval of a ballot question or (2) a petition process and voter approval of a ballot question.

TR: What happens to the CPA surcharge receipts?

JC: Surcharges, and the other revenue appropriated to the Community Preservation Fund by a “blended” CPA community, are credited to the local CPF and may be appropriated on the recommendation of the Community Preservation Committee for community preservation purposes under the CPA law.

TR: What are state matching funds?

JC: A Community Preservation Trust Fund is established at the state level which is funded by surcharges on recording fees at the Registry of Deeds and Land Court. All municipalities imposing a surcharge the previous year receive a first round state match.

TR: Our Budget Bulletin begins with a total number of cities and towns that have accepted the CPA that are eligible for state matching funds in the upcoming fiscal year. How does BOA know the correct number of acceptances and are they all eligible for state matching funds?

JC: Once the CPA has been accepted by either (1) a majority vote of the municipal legislative body followed by a majority vote of the electorate or by (2) a majority vote of the electorate after filing a local ballot question petition signed by at least 5% of the municipality’s registered voters, municipal clerks are required to submit a CPA Notification of Acceptance form to the Municipal Databank in the Division of Local Services (DLS). This notification is important, not only for tracking acceptances, but for distributing the state matching funds because the Municipal Databank is responsible for the distribution.

Because a municipality must commit one fiscal year of surcharges prior to receiving a state match, cities and towns where the CPA takes effect on July 1, 2018 will receive their first state match distribution in November of 2019, in FY2020. In FY2018, 172 municipalities committed the CPA local surcharge and will be eligible for the State match in FY2019. In FY2018, 162 cities and towns received just over $24 million for the FY2018 state match.

TR: The Bulletin then indicates a percentage first round state match as determined by the Municipal Databank. Why is this estimate so important?

JC: The CPA calls for up to three distribution rounds. All cities and towns that imposed a surcharge the previous fiscal year will receive first round match distributions. The estimate is important for local Community Preservation Committees to properly budget revenue to be received from the State’s Trust Fund in the upcoming fiscal year. For FY2019, the Databank has estimated a first round match of 11.5% of the municipality’s surcharge imposed in FY2018.

TR: How is the first round match estimate determined?

JC: The process of estimating the first round match is a bit complicated, but here is a very basic overview. The Databank estimates the match by:

TR: Why did our first round percentage estimate drop from FY2018 to FY2019?

JC: The FY2018 first round estimate was 15%, but the actual match was 17.2%. The actual percentage exceeded our estimate. But for FY2019, the estimate is 11.5%. I see two reasons for the estimate’s decline. The first and main reason is that recent legislative changes to the CPA have attracted 10 additional cities and towns, including several larger cities, to accept the law and these entities are now eligible to receive a state match in FY2019. The second reason is that fees taken in by the Registry of Deeds and Land Court that provide revenue for the match have remained stable. As a result, the percentage of the state match has decreased.

TR: As for the other distribution rounds, which cities and towns are eligible?

JC: We already know that municipalities that imposed a surcharge in the prior fiscal year are eligible for the first round distribution. If monies remain, there is a second or equity round and a third or surplus round distribution to cities and towns that have adopted the maximum 3% surcharge. The most a city or town may receive in state matching funds in any year is 100% of the total surcharge it assessed in the previous fiscal year.

TR: How is the state match determined for a “blended” CPA municipality?

JC: For these cities and towns, the state match is based on surcharge collections in the previous fiscal year plus the amount of the additional revenue appropriated by the municipality to the CPF by June 30 of that fiscal year. To be eligible for additional rounds of state matching funds, the “blended” CPA municipality must have appropriated additional municipal revenue to the CPF so that the total funds, additional appropriated municipal revenues plus surcharge, equal 3% of the real estate tax levy. The most a “blended” CPA city or town may receive in state matching funds in any year is 100% of the total surcharge assessed in the previous fiscal year plus additional funds appropriated in that fiscal year to the CPF.

TR: How many cities and towns have accepted the 3% maximum surcharge?

JC: Currently, for the 172 municipalities that have accepted the CPA, the breakdown of percentages accepted is:

Included within the 1% and 1.5% categories are five municipalities that have adopted or amended their CPA adoption to a “blended” CPA.

TR: The Bulletin says that the equity and surplus distributions will increase a city or town’s reimbursement depending upon their decile and total surcharge amount. What is a decile, and why will reimbursements increase because of it?

JC: It would probably help if I explain how the second and third rounds work. The 20% reserved in the state trust fund before the first round is calculated is used to determine the second or equity distribution round by dividing the remaining fund balance by the number of cities and towns receiving distributions. This result is called the “base.”

Every municipality’s equalized valuation or EQV per capita and population is then ranked from highest to lowest and the ranks are averaged to get a “raw score.” The “raw scores” are then ranked from lowest to highest and the cities and towns are placed into what are called deciles. Each decile has 35 municipalities, except decile 1 has 36. Each one of the 10 deciles has a percentage of the base assigned to it in descending order from 140% to 50%. Decile #1 is assigned 140%, decile 2, 130% and so on.

By formula, municipalities in the lower deciles (for example 1, 2, or 3) are determined to be those most in need and will receive a greater percentage share of the “base.”

If money is still available in the state trust fund after the second round, there is a third or surplus round. A new “base” is determined just as in the second round that is then multiplied by the same decile percentage used in the second round.

TR: How about a quick example?

JC: Let’s say that Community A accepted a surcharge percentage of 3% and is therefore eligible for three rounds of distribution and let’s say that money will be available in the fund after rounds one and two.

Now, let’s say that Community A collected a previous fiscal year surcharge of $1 million and the next fiscal year’s actual first round match is 17.2%. In the next fiscal year, Community A will receive a match of at least $172,000.

In the second round, Community A’s EQV and population was averaged to give it a raw score which was then ranked against all cities and towns. A base was calculated at $45,000. Community A’s ranking placed it into the fourth decile which allows an equity distribution of 110% of the base, another $49,500 or $45,000 times 110%. In the third round, after a new base of $25,000 is determined, Community A’s 110% decile percentage from the second round allows a surplus distribution of $27,500, or $25,000 times 110%. In total for the three rounds, Community A will receive a distribution of $249,000 from the state trust fund.

TR: Finally, the Budget Bulletin indicates that the estimates are subject to change depending upon Registry of Deeds collections between the time of the Bulletin and October of that year. Why does that time frame make a difference?

JC: The time frame when we issue our Budget Bulletin through October is important because actual Registry of Deeds and Land Court fees will be deposited into the State Trust Fund. The Databank does a great job estimating the amounts that will be collected, however; the actual receipts are what the final distribution in November is based on.

TR: Is there more than one distribution in a fiscal year?

JC: The only distribution for the fiscal year is in November provided the city or town submits to the Databank forms CP-1 and CP-3. Form CP-1 is available in Gateway and form CP-3 is available from Mass GIS after entering your community’s password issued by the DLS Databank. Contact the Databank to obtain a password. Any questions concerning the completion of the CP-3 should be directed to the Community Preservation Coalition at (617) 367-8998.

TR: Thank you for your explanations, Jared. I’m sure our readers will now more fully understand the Bureau’s guidance.

JC: Thanks, Tony!

The authors would like to thank Lisa Krzywicki, Director Municipal Databank/Local Aid Unit, and Patricia Hunt of the Bureau of Municipal Finance Law for their help in reviewing this article.

Comments Off on Community Preservation Act primer

Posted in Community Preservation Act (CPA), State

Comments Off on BoS agenda for 8/14/18

Posted in Select Board matters