This came yesterday too, from former resident and legislature watcher, John Nunnari:

HOUSE, SENATE RUSH OVERDUE $40.2 BILLION BUDGET TO BAKER [+MEDIA]

By Michael P. Norton

STATE HOUSE NEWS SERVICE

STATE HOUSE, BOSTON, JULY 7, 2017…..Largely discarding spending plans they approved in the spring, the House and Senate on Friday sent Gov. Charlie Baker a $40.2 billion state budget that holds state spending flat, includes higher employer health care assessments, and, according to some Democrats, underscores the need for higher taxes and new revenues.

The bill was rushed through the House on a 140-9 vote and then cleared the Senate 36-2. After the votes, Democratic legislative leaders offered differing points of view on their final product.

“In the midst of a tough fiscal climate we’ve delivered a responsible budget that makes targeted investments and protects our most vulnerable citizens,” House Speaker Robert DeLeo said. “I am particularly proud of the work we’ve done on early education and care – which will have a lasting impact on both the workforce and the Commonwealth’s children – and supporting those battling addiction.”

Senate President Stanley Rosenberg took a more dim view of the budget, calling it “the harshest state budget since the last recession.”

“It would have been somewhat better had it contained the Senate’s modest revenue proposals including those on Airbnb, internet hotel resellers, flavored cigars, film tax, and the Community Preservation Act,” he said. “We can take some measure of pride in what we were able to do for local aid, children, and veterans, but too many were left behind.”

Lawmakers put aside many investments they had planned and settled for a budget with a bottom line that roughly mirrors projected state spending for last fiscal year. They did so because tax revenue growth forced them to mark down available revenues by $733 million.

“This budget is not without pain,” Senate Ways and Means Chairwoman Karen Spilka told reporters. “It’s clear that the state is facing a shortfall in revenue that will have an impact on real people’s lives and there are cuts throughout this budget.”

SHNS Video: Sen. Spilka briefing

Asked to identify some of the cuts she described as painful, Spilka said there were reductions in the Executive Office of Human Services and lawmakers were unable to preserve full funding for an account that helps cities and towns pay special education costs.

Spilka said members of a conference committee also pulled aside $104 million for a new reserve fund to cover spending in county sheriff offices and the Committee for Public Counsel Services, the state’s public defender agency. The revenue gap was primarily covered through $502 million in spending reductions, $205 million in “efficiencies and reversions” and the $83 million in revenue from not meeting a trigger to reduce the income tax rate, Spilka said.

House budget chief Rep. Brian Dempsey said the revenue markdown forced $400 million in changes to line items, but said he would hesitate to describe them as cuts because he said in many cases fiscal 2018 spending levels will be higher than levels in the original fiscal 2017 budget.

“These reductions are never easy,” Dempsey said.

SHNS Video: Rep. Dempsey briefing

The Department of Developmental Services will receive a $57 million increase over last year’s budget, but not the $84 million increase the House had initially proposed, Dempsey said.

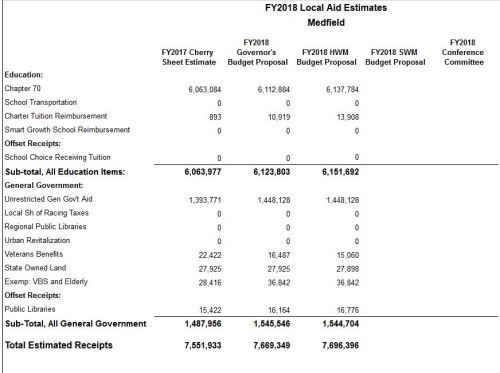

The budget, Dempsey said, recognizes the problem of “revenue growth slippage” — Spilka called it a “new fiscal reality” — but still invests $40 million in unrestricted local aid, $119 million more in school aid, and $15 million to address the salaries of early education workers.

“I am very pleased that local aid was maintained,” said House Minority Leader Brad Jones, who took issue with the budget development process, which has been marked by a high level of secrecy. Jones also suggested the budget was balanced only by consciously underfunding accounts.

Rep. James Lyons, an Andover Republican, said the budget is predicated on “hopeful” levels of revenue growth, suggesting a 2.9 percent rate of growth is too optimistic since collections over the past year have grown by about 1.4 percent. “These revenue numbers are not going to meet the expectations,” Lyons said.

Another Republican, Rep. Shaunna O’Connell of Taunton, said the rushed vote on the bill that was released Friday morning made it “impossible” for legislators to know for sure what was in the budget and what had been left out.

Senate Democrats shot down a bid by Senate Minority Leader Bruce Tarr to give senators more than a few hours to read the budget before voting on it. Noting an interim budget is in place for the month of July, Tarr said the Senate could afford to postpone the vote until next week.

“It is inappropriate for us at this time to consider a document filed just a few hours ago,” the Gloucester Republican said. “It is more than 320 pages and spends more than $40 billion, which members have had a chance to review for only a very short period of time.”

Sen. William Brownsberger said he viewed Friday’s vote as one of “do I want the state to run or do I not want the state to run.” He noted that the Senate could have waited but that the conference committee report could not be amended regardless.

“We could do it later, but it’s not going to change. The deal’s not going to change,” he said. “I have confidence in the Senate Ways and Means team, I think they did the best they could and it is what it is.”

The budget features new assessments on employers designed to generate $200 million to help the state keep up with the rising costs of MassHealth, the public health insurance program that serves about one million people.

One assessment will boost a per-employee assessment paid by employers from $51 to $77 per year, while another will hit employers with up to $750 per employee if their workers choose MassHealth even though they have access to insurance through their employers.

The new assessments are coupled with plans to reduce the size of a scheduled increase in unemployment insurance rates to $500 million, from $850 million, but House and Senate Democrats discarded MassHealth reforms that Baker recommended in June and which employer groups had hoped would be coupled with the new assessments.

“The proposed state budget fails to honor a compromise reached with the business community that promised reforms alongside any assessment to close MassHealth budget gaps,” Christopher Carlozzi, Massachusetts state director of the National Federation of Independent Businesses, said. “The cost of healthcare is a top issue for Massachusetts small business owners and adding an additional assessment without reining in the cost of a bloated MassHealth program is irresponsible and guarantees the promise of greater budget problems in years to come. The legislature needs to understand that ‘shared responsibility’ is not a one-way street that consistently requires funds from the small business community without addressing the underlying cost drivers.”

Democrats in the Legislature said the budget requires Baker to extract $150 million in savings at MassHealth, but took pride in ruling out eligibility and benefit standard changes. Rep. Christine Barber claimed Baker’s plans would have “undermined” the state’s health care coverage goals.

The compromise budget retains a planned $100 million deposit into the state’s “rainy day” fund, a commitment that Dempsey said could prove important to credit rating agencies who have questioned the strength of the state’s reserves. The deposit would bring the total balance in the fund to $1.4 billion by the end of the fiscal year, but about half of it is contingent on capital gains tax revenues meeting projections.

Dempsey also noted that the House’s marijuana regulation bill, which is still tied up in negotiations, includes $50 million for substance abuse treatment from taxes on retail pot sales, which the House proposed to tax at 28 percent, but the Senate has favored a 12 percent tax.

“It’s a tremendous opportunity, I think, to tax an industry that ought to see a higher tax and use that money really for the betterment of the citizens of the commonwealth and treatment,” he said.

The consensus budget sided with the Senate on a reserve for the implementation of the new marijuana law, appropriating $2 million rather than the House’s approved $4 million.

Jim Borghesani, spokesman for the Yes on 4 Coalition and the Marijuana Policy Project, said the $2 million reserve “falls far short of the funding necessary to build an effective regulatory structure in the time set by the Legislature and the governor.”

“The cost of licensing and tracking software alone, which must be in place before applications can be processed, is estimated at $5.5 million,” Borghesani said. “The Treasurer requested $10 million for the year-one budget. We take elected officials at their word that there will be no more delays, and we hope funding is set at the amount necessary to prevent any more of them.”

The final budget keeps the University of Massachusetts system on track for what UMass President Marty Meehan projected will be a 2 percent to 3 percent hike in student charges this year, including the House’s appropriation of roughly $513 million. Higher education advocates and UMass officials had hoped negotiators would stick with the Senate’s higher figure of $534 million, which was about $4 million shy of the university’s request.

The advocacy group Public Higher Education of Massachusetts said the budget “hurts students and families” by underfunding UMass by $30 million, with state universities and community colleges faring “not much better.”

The budget deal does not include a Senate amendment that municipal officials urged the conference committee to preserve in order to rejuvenate the collapsing partnership between the state and communities that have raised property taxes under the Community Preservation Act.

Lawmakers spared from cuts their planned investments in local aid. “It is absolutely clear that the Legislature looked to protect cities and towns from the state’s revenue challenges,” Geoff Beckwith, executive director of the Mass. Municipal Association, said.

Spilka said budget conferees left out MassHealth reforms recommended by Baker in June dealing with eligibility and benefit changes because they “rejected the notion that we should accept the governor’s health care proposal without the necessary transparency.”

“At a moment when we are rightly horrified by the lack of transparency in the health care debate on the national level, it’s important that we must stick to our principles and ensure such an important proposal for Massachusetts and its residents goes through the proper process,” she said.

According to House officials, the budget is predicated on tax revenues growing 2.9 percent rather than the originally anticipated 3.9 percent, and the budget’s $40.2 billion bottom line is about $1 billion higher than the budget approved at this time last year.

Projected fiscal 2017 spending is estimated at more than $40 billion despite only a 1.4 percent increase in tax revenues last fiscal year, a growth level that prompted Gov. Charlie Baker to hold down agency spending and raid trust funds for nearly $140 million.

Sen. Sonia Chang-Diaz, a Jamaica Plain Democrat who joined Webster Republican Sen. Ryan Fattman in opposing the budget, told the News Service afterward she was “still grappling” with her vote.

“At some point I think you have to be willing to recognize when you are the frog in a boiling pot of water and say, ‘This is not good enough, there are some choices that we could have made without adding a penny to the bottom line that would have done better for the people of Massachusetts,'” she said.

The budget includes “some painful cuts” to elder services programs but does not “appear to materially impair these services overall,” according to Mass. Home Care executive director Al Norman. More than $5.6 million was cut from Executive Office of Elder Affairs line items, according to Norman, who said there should still be sufficient funding to avoid a waiting list for home care services.

Supporters of a proposed surtax on high earners, a proposal marked for a 2018 ballot vote that could generate $2 billion, say low tax revenue growth, rising health care costs and spending demands, and the threat of federal funding cuts are forcing the state to weigh new revenues.

“The projected revenue shortfalls forced the Legislature to abandon some of the modest investments their earlier budgets had sought and led to even greater reliance on temporary measures to balance accounts,” Noah Berger, president of the left-leaning Massachusetts Budget and Policy Center, said in a statement. “Unfortunately, this budget does not even begin to make the kind of major long-term investments that would improve our economy and quality of life by expanding educational opportunity for all of our young people and enhancing our failing infrastructure. Doing that would require fixing flaws in our tax system that allow the highest income residents of the state to pay the smallest share of their income in state and local taxes.”

Given the spending choices lawmakers were forced to make, Dempsey said he and other House leaders might be thinking differently about pursuing additional sources of revenue through taxes or other means if it weren’t likely that voters will decide next year whether to impose a 4 percent surtax on income over $1 million.

“If that were not out there, I think you’d look at it a little bit differently,” Dempsey said.

Newton mayor and Democratic gubernatorial candidate Setti Warren released a statement Friday afternoon expressing concerns with the spending plan.

“By continuing the annual spectacle of using one-time fixes, fiscal sleights of hand and gimmicks to fix the budget, Beacon Hill has decided we are a Commonwealth that will not recognize the truth that state government needs new revenue,” Warren said. “If we don’t fix this broken budget process – if we don’t stand up and demand transparency and admit that we need new revenue – the toll on the Commonwealth will only get worse. The key question facing us is what kind of Commonwealth we want to be. This budget and the way it was developed and passed suggest the Commonwealth we are becoming needs to change.”

Warren also criticized the conference committee’s omission of language directing officials to study the feasibility of building a high-speed rail line between Boston and Springfield. The Senate had unanimously backed the study, an amendment offered by East Longmeadow Democrat Sen. Eric Lesser, saying it train service would allow for a better link between the economies of greater Boston and western Massachusetts. Baker vetoed a similar study from last year’s budget.

[Matt Murphy, Katie Lannan and Colin A. Young contributed reporting.]

END

07/07/2017

Serving the working press since 1894

http://www.statehousenews.com

For assistance with your subscription to the State House News Service, reply to this message or e-mail news@statehousenews.com.