Mike Circulated this draft of the Board of Selectmen’s annual report material this week –

Review of Town Finances

The Warrant for the 2017 Annual Town Meeting is unusually long. This is both because of the number or articles (50) and the length of several of the articles. With the total number of pages approaching 100, it was not possible to prepare this Warrant Report in the usual booklet form without binding it at a considerable expense, similar to the way the town report is bound. The decision was made to print the Warrant Report on 8 ½” X 11” sheets.

The Message from the Moderator at the beginning of this report details the Town Meeting procedures. Please read his Message for information on these matters. Also, in order to avoid adding more pages to this Warrant Report this Review will be shorter than usual.

REVENUES

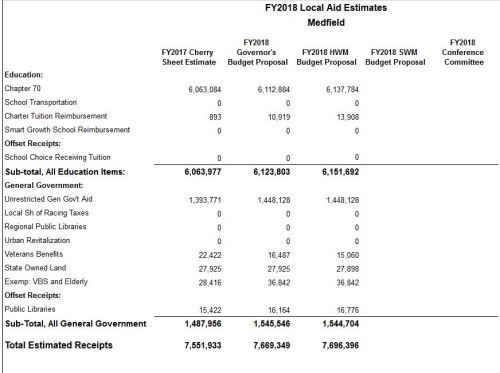

The tax levy estimate following this Review projects that the total revenues available for fy18 will be approximately $62.6 MILLION. Actual revenue amounts will not be available until well after the Town Meeting, when the State Budget for Local Aid to Cities and Towns is approved, new property tax base growth is determined and books for fy17 are closed. At present, the best estimate for increases in revenues without any new Propositions 2 ½ property tax overrides is $520,000. This, however, is somewhat misleading in that some of the changes in revenues are the results of shifting funds from one account to another, such as moving money from the OPEB Stabilization Fund to the OPEB Trust fund last year. The main increases in new revenues for next year are $955,000 for the permitted 2 ½ annual property tax levy increase; $350,000 for new growth in the property tax base from new construction, land subdivision, etc.; $117,000 from Local Aid to Cities and Towns, mostly for Chapter 70 School Aid, $211,000 from increases in Local Receipts (Motor Vehicle Excise Tax, licenses and permits, rental income, fees and fines, transfer station stickers, etc.) Other smaller revenue sources make up the rest of the Revenue Total.

EXPENDITURES

Within the tax levy limit

The tax levy estimate projects that expenditures for fy18 will total $63.7, an increase of about $900,000 over fy17 expenditures. Here also, as with the revenues, the increases are somewhat misleading, as some of the expenditures for special articles are transfers of funds and do not create actual expenditures. To see what the requested increases are you should check the expenditure categories in the tax levy estimate, which follows this Review. In addition, since operating budgets comprise about 95% of total expenditures, you can see the increases (decreases) in the individual departmental operating budgets as shown in Article 13, the Operating Budget. Other operating expenditures are for several of the other warrant articles on this year’s warrant and include $358,500 for Chapter 53E ½ Revolving Funds (see Articles 5 and 6 for explanations and breakdowns); $472,623 for The Capital Budget (Article 14), funding for the Other Post-Employment Benefits Trust ($400,000) (Article 30), the Iron Manganese Treatment facility ($275,000) (Article 35), to reimburse the Stabilization Fund for last year’s loan to purchase a new ambulance ($50,000) (Article 29), to transfer Sewer Betterment Funds Paid-in-Advance to the Sewer Betterment Stabilization Fund ($158,287) (Article 28), for maintenance, security and consultants for the former state hospital site ($200,000) (Articles 18 & 19), to purchase street lights ($67,626) (Article 25), to transfer cemetery lot purchase funds to the Cemetery Perpetual Care Fund, ($43,650) (Article 3). Additional warrant articles with funding requests includes articles for downtown improvements, downtown parking study, maintenance of the Dwight-Derby House, beaver trapping and dam removal, design of a rail trail, naming of the Elm Street bridge, payment of a prior year (Fy16) Police Department bill, and wetlands delineation of a potential site for senior housing. For more information on any of these articles you can check the Index of Articles at the end of the Warrant Report to locate the page and/or article number.

Over the tax levy limit

There are two funding articles on this year’s town meeting warrant that weren’t mentioned above. One of these is Article 15, which seeks funds for the Fire Department Budget in order to provide for continuation of Advanced Life Support services in conjunction with the Town’s ambulance. In recent years these services were provided as a private intercept service (usually meets the ambulance on its way to the hospital) with a specially equipped vehicle and highly trained staff called, as necessary, for ambulance runs requiring such services. This past year that company notified the Fire Department that they would no longer be available to provide such services. Another intercept service was brought in but also withdrew. This article presents alternative solutions to maintain ALS service, either by adding ALS certified EMT staff to the Fire Department budget or by finding another private intercept service, perhaps on a regional basis. Either way is expensive and would require a Proposition 2 ½ operating override to provide sufficient funds. Recommendation on how to proceed will be forthcoming at the Town Meeting.

An operating override can only be voted on at an election, not at a town meeting. An operating override adds a permanent amount to the property tax base. If the Town Meeting votes to approve funding requested in this Article, the Board of Selectmen will have to call a Special Town Meeting for an override vote.

The other article not discussed above is Article 17, which calls for an appropriation of $1 Million to be funded by a bond issue for the purpose of providing funds for affordable housing. This Article was submitted as a citizen petition. In all likelihood, if Article 17 passes, these funds would be turned over to the Medfield Affordable Housing Trust, created under Article 16. This Trust would determine how to use these funds to best meet the Town’s affordable housing needs/requirements. Like the ALS article discussed above, funding this appropriation /bond issue would require a Proposition 2 ½ vote at an election. In this case, however, the vote would be a debt exclusion vote, which would exclude annual principal and interest payments over the life of the bond issue from the calculation of the tax levy limit. When the bond issue was paid off, this debt exclusion would end and would not become a permanent part of the tax levy.

USE OF FREE CASH

From the above you should note that the total expenditures are greater than the total revenues, even without the override article amounts, by about $1.1 Million. In other words, the Town’s Budget, is out-of-balance. Since the Town must balance its budget each and every year in order to have its tax rate approved by the Massachusetts Department of Revenue, this difference must be made up. Some of this deficit is raised by using free cash to cover specific appropriations, such as $200,000 for the OPEB appropriation. The rest is covered at the end of Town Meeting by voting to authorize the Board of Assessors to use an amount of free cash in the Treasury. Free Cash consists of unallocated funds on the Town’s books at the end of each fiscal year. It must be certified by the MA Department of Revenue before it can be voted out by the Town Meeting (see explanation for Article 50). At the end of each fiscal year any unused free cash, in effect, disappears until the next fiscal year’s books are closed and a new free cash amount is certified. Local government accountants, auditors and financial advisors recommend that the level of free cash (think checking account) plus stabilization funds (think savings account) should equal or exceed 5% to 10% of its annual budget. In Medfield’s case, that would be between $3.1 million and $6.2 million. In addition to helping the Town maintain its excellent credit rating, free cash is used to avoid short term borrowing interest costs and to have funds on hand to cover emergency conditions. And remember, Free Cash isn’t free.

OTHER ARTICLES

There are a number of articles on this Year’s Town Meeting Warrant that don’t require an appropriation, but are significant in determining how the Town runs and what additional costs may be incurred or saved from passage of these articles. Article 16 would establish the Medfield Affordable Housing Trust, a semi-autonomous Board appointed by the Selectmen to address the needs and requirements for developing affordable housing in the Town. Articles 31 & 32 would accept streets as public ways or public right-of –ways. Article 33 would adopt a water conservation bylaw and Article 34 would authorize the Water Department to enter into private property to inspect, repair or replace water meters, Article 36 would authorize the Board of Selectmen to lease space on the new Hospital water tower for wireless communications, Articles 37 & 38 would adopt new stormwater management and water pollution abatement bylaws to bring the Town into compliance with federal stormwater management permit requirements, Articles 39 to 47 propose changes to the zoning bylaw affecting single, two family and multifamily housing and inclusionary requirements for affordable housing, Articles 48 & 49 deal with regulation of recreational marijuana.

CONCLUSION

At the beginning of this year’s budget process, it looked like the Town might need an operating budget override to cover departmental budget increase and increases in pension and health insurance costs. However, as a result of the hard work of the Warrant Committee, various Town Boards, Committees and Department Heads, the budget can be balanced without an override and without sacrificing essential Town services. It took a lot of night meetings, deliberations and compromises to accomplish this. Medfield is fortunate to have such a dedicated group of volunteers and employees working on its behalf to keep the Town on a sound financial footing. The voters will still have to decide on the two potential overrides, one to fund the affordable housing efforts and the other to maintain ALS support services. Please do your part in helping to make all of the decisions that are on this year’s Town Meeting Warrant and on whether or not to fund the two potential tax override requests that may have to be voted at a special election, if the Town Meeting passes the corresponding Town Meeting warrant articles. It’s your Town, so please do your part.

Mark L. Fisher, Chairman

Osler L. Peterson, Clerk

Michael T. Marcucci, Third Member

Board of Selectmen