From Stephen Callahan, Chair of the Warrant Committee, this afternoon –

Comments Off on Warrant Committee on Budget/Override

Posted in Budgets, Financial, Town Meeting, Town Services, Warrant Committee

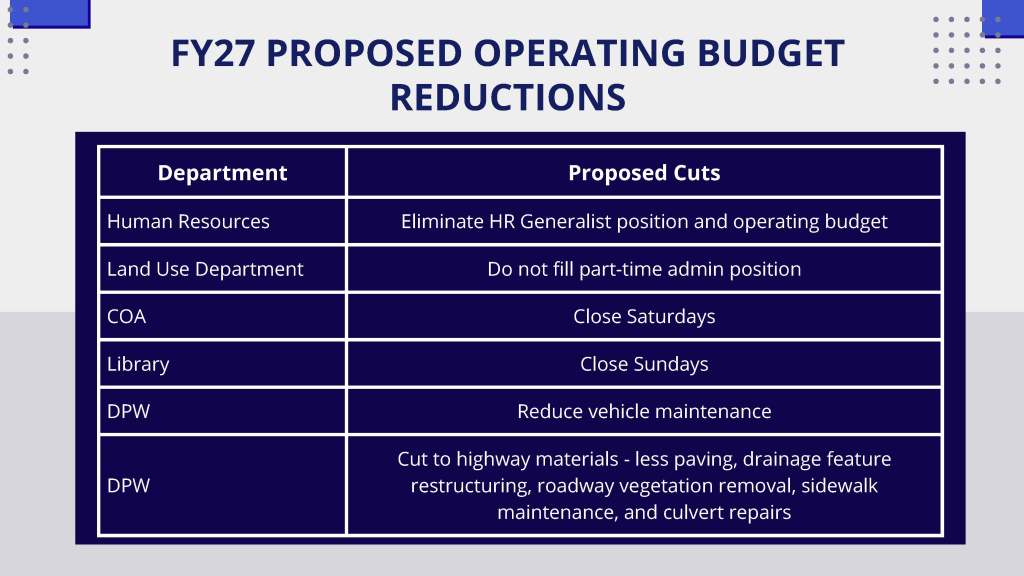

From Town Administrator, Kristine Trierweiler this morning, her FY27 PROPOSED OPERATING BUDGET

REDUCTIONS to the Warrant Committee last night –

Comments Off on FY27 PROPOSED OPERATING BUDGET REDUCTIONS

Posted in Budgets, Financial, Town Meeting, Town Services

GET THE FULL ARTICLE VIA THE LINK BELOW:

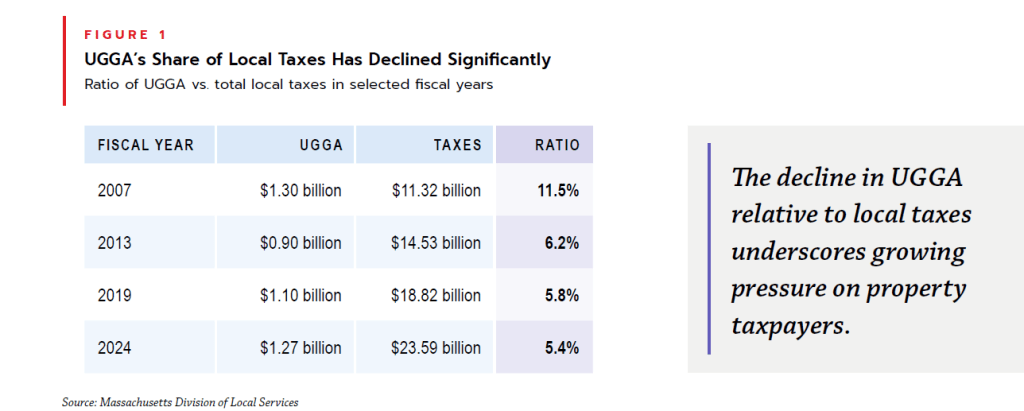

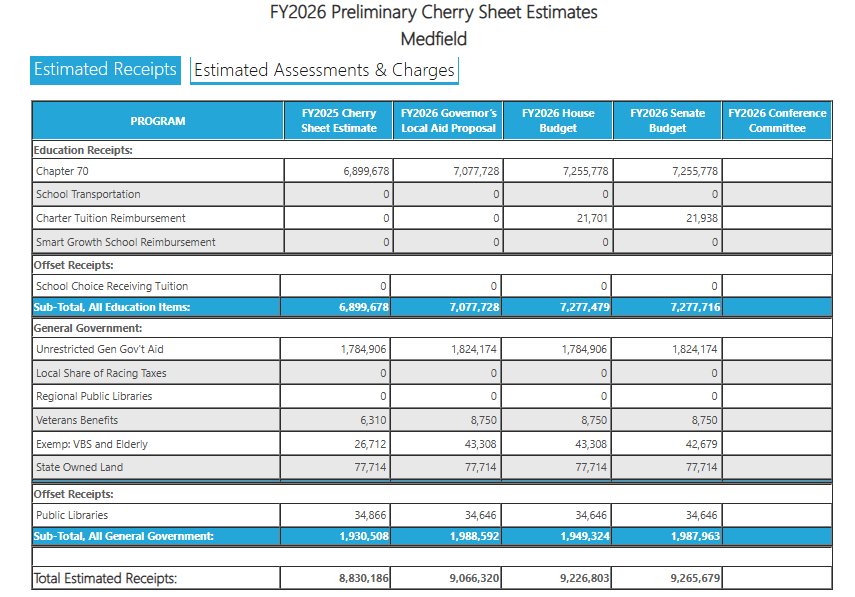

State aid – Unrestricted General Government Aid, or UGGA – to Medfield has declined for decades, and today is at less than half the level of our real estate property tax revenue that it was in 2007. The declining state aid has increasingly moved municipal services from being funded by the state income tax to the local property tax.

Thanks to Steve Callahan, Chair of the Warrant Committee for circulating the link to the Massachusetts Municipal Association piece that Assistant Town Administrator, Brittney Franklin shared with him.

Thanks too to the Massachusetts Municipal Association for focusing on this issue of inadequate and declining state funding.

Comments Off on MMA Suggests Solutions to Declining State Aid

Posted in Budgets, Financial, Legislature, Select Board matters, Warrant Committee

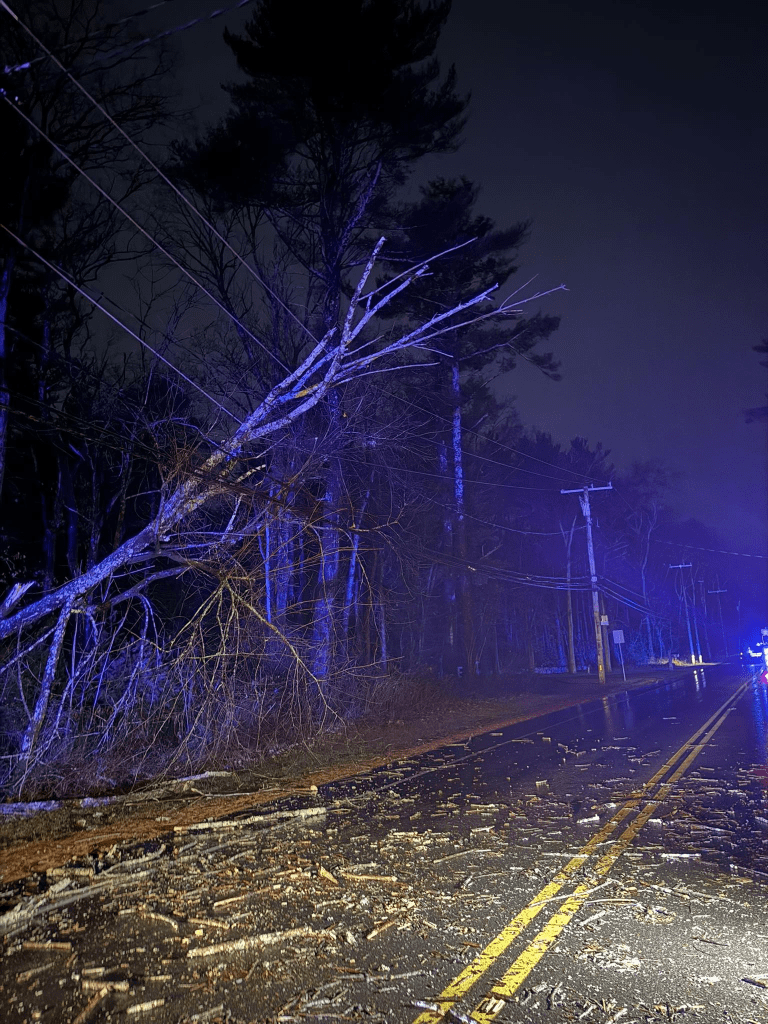

MEDFIELD POLICE DEPARTMENT photo –

The Warrant Committee’s joint budget workshop with the Select Board and School Committee last night was ended by this tree on the wires along Main Street that turned off the electricity to the Medfield High School library, putting the meeting into darkness – the MHS’s emergency generator failed to come on. The meeting proceeded in the dimness for a short time illuminated only by the light from the computer screens and cell phones, and apparently was still being broadcast on backup power.

The workshop discussion will be re-scheduled and the discussions will continue.

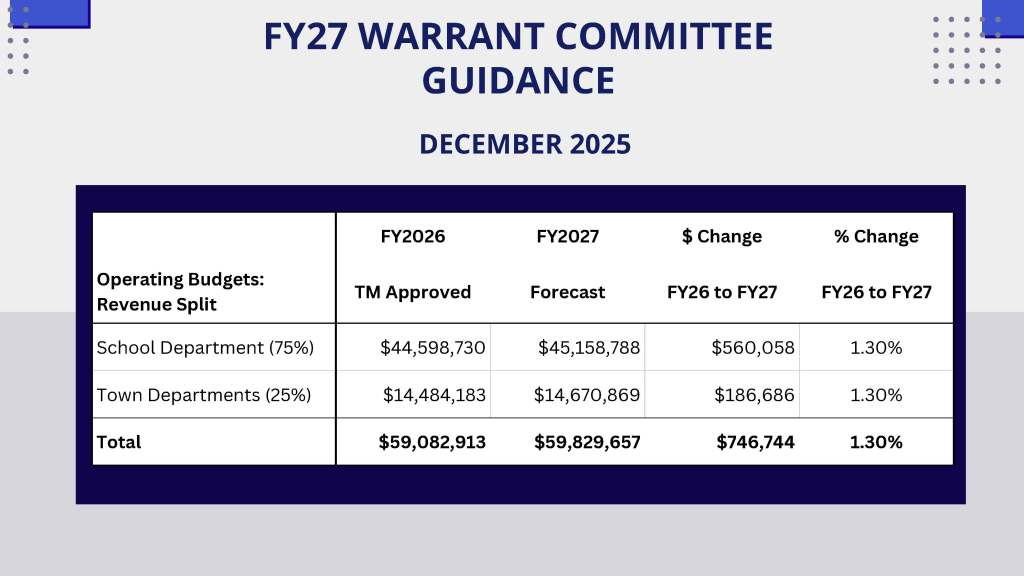

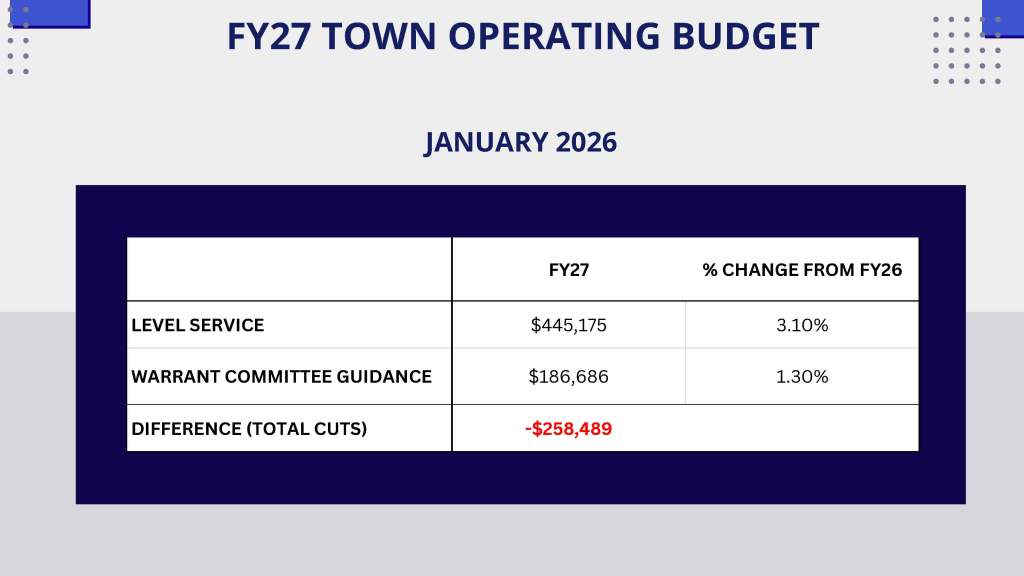

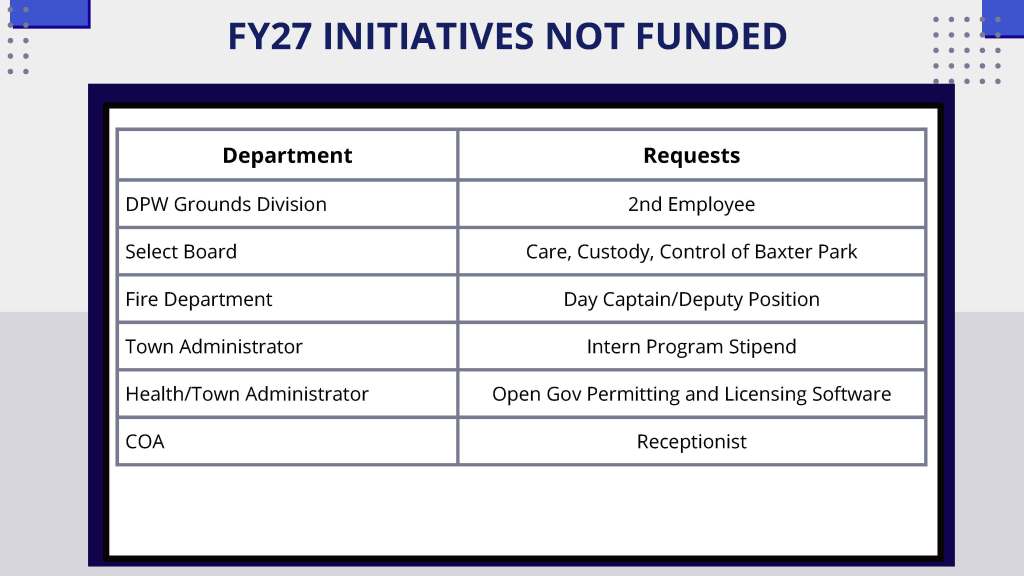

Issue = only an additional 1.2% budget monies are available for spending increases for FY27, so even level funding is not possible. Plus large capital expenses required:

Overrides seem needed, unless residents want fewer services.

Thank you to the Warrant Committee for starting the discussion!

From the Globe –

By Ross CristantielloOctober 7, 2025 | 11:24 AM

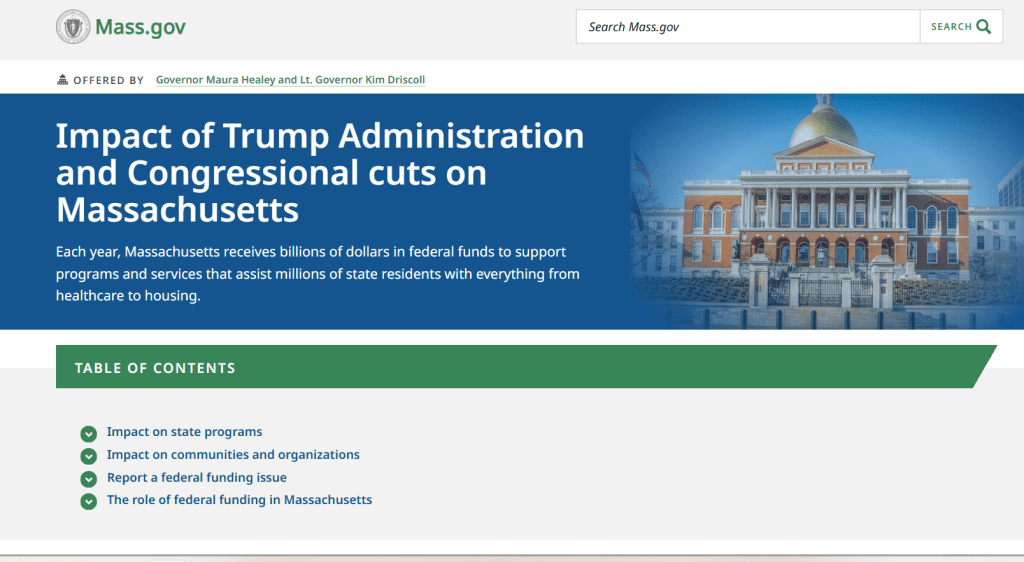

Massachusetts officials launched a new online dashboard this week designed to clearly show how federal funding cuts are negatively impacting Massachusetts under the Trump administration. All told, the state has lost about $3.7 billion due to President Trump and a Congress beholden to him, according to the dashboard.

From Massachusetts state website –

Comments Off on Massachusetts losing $3.7 billion to Trump policies, per state dashboard

Posted in Budgets, Federal Government, Financial, State

| Read Online New tax provisions brings a $650M state budget hit with the shutdown adding to the woes |

Just three months into the new fiscal year, lawmakers learned about a new wrinkle caused by the One Big Beautiful Bill: federal tax law changes within the new law that could remove $650 million in state tax revenue supports that are holding up the $61 billion annual budget. The sweeping federal legislation, signed the same day as the state budget, could siphon hundreds of millions from Beacon Hill’s coffers, a development disclosed at an economic roundtable. The news is forcing lawmakers to rethink core assumptions and scramble for possible fiscal workarounds. Add a full-blown federal government shutdown to the mix, and the state’s economic footing looks shakier by the day. The shutdown became official on Wednesday. Federal offices closed. Economic data streams went dark. Gov. Maura Healey didn’t mince words: “It’s terrible for our country.” She blasted Congressional Republicans for “driving us over a cliff.” Roughly 45,000 federal workers who live in Massachusetts could be facing furloughs, and state officials began preliminary planning last week to keep key programs afloat while federal dollars are paused. The U.S. Department of Labor also confirmed that Friday’s national jobs report would be shelved, sidelining data that influences economic, government and business decisions. On Tuesday, Revenue Commissioner Geoffrey Snyder dropped the news about the $650 million exposure that occurs because the state is “coupled” with many federal tax provisions, creating ripple effects. “This is one of the more challenging times that we’ve faced from a fiscal perspective,” said House Ways and Means Chair Aaron Michlewitz, noting that while several options are on the table, few are ideal. Budget leaders are now weighing, at a minimum, whether to dip into reserves, revise revenue forecasts mid-year (a decision due by Oct. 15), or decouple state tax law from specific parts of the federal code. Administration and Finance Secretary Matt Gorzkowicz was blunt: “There’s a lot of uncertainty, and there’s a lot of things we have to consider in managing that.” Pressed on whether midyear budget cuts might be necessary, Gorzkowicz said simply: “I don’t know.” The state does $860 million in unallocated funds built into the budget, perhaps with some foresight of what was coming but possibly also due to the common legislative tendency to pass supplemental budgets. Sen. Michael Rodrigues, however, signaled restraint around the state’s over-$8 billion reserve fund: “We have other tools available. I’d be hard-pressed to suggest dipping into the Stabilization Fund right now.” |

Posted in Budgets, Federal Government, Financial, Legislature, State

From the Statehouse News Service Weekly Roundup (that former Medfield resident John Nunnari faithfully continues to share with me weekly, despite being gone 5+ years) –

“State tax collections continue to cruise, putting the total haul with just one month left in the fiscal year more than $2.8 billion ahead of last year’s pace”

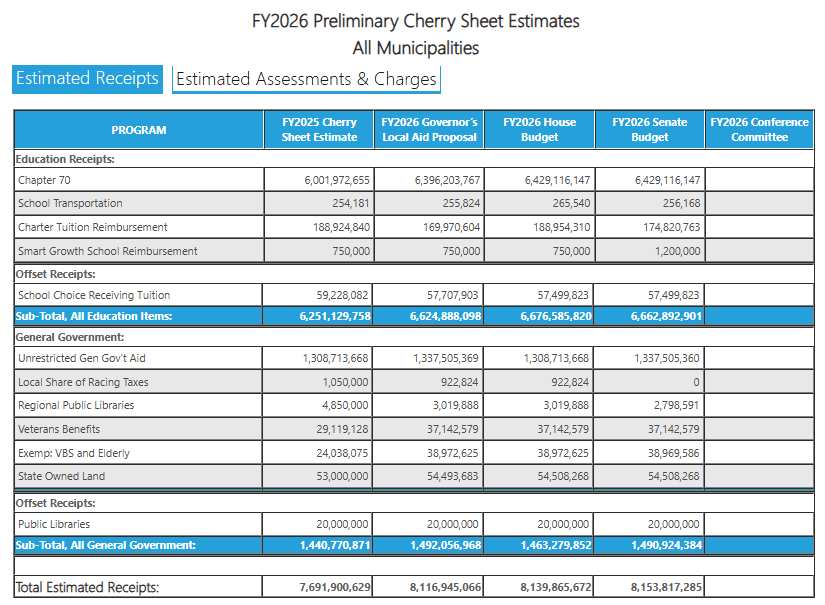

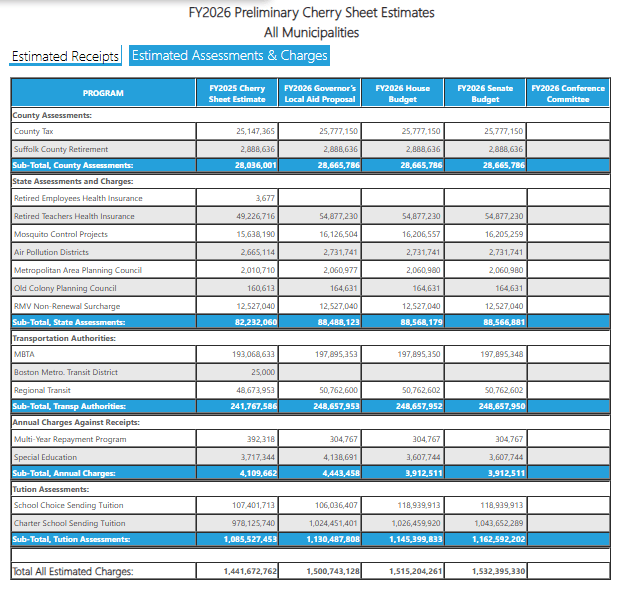

Yet the state is not sharing so much with Medfield this year. Current Cherry Sheet estimated increases for state revenue sharing with towns over last year are modest.

Comments Off on State Flush with $, but not Sharing

Posted in Budgets, Financial, Legislature, State

The Senate released its cherry sheet budget numbers today, and the Senate’s money for Medfield tracks the House and Governor’s budget amounts fairly closely – meaning that the town will not likely see much increase in state aid next year.

Comments Off on Senate Budget #s – similar to House & Gov

Posted in Budgets, Legislature, State

Looks to be a lean year for Medfield’s state aid, as the Senate Ways & Means Committee added less than $40K to the House budget numbers for Medfield, which were already only small increases. All the state $ must be going for the $25m. parking garage in the Speaker’s district:

Comments Off on Senate Ways & Means adds less than $40K for Medfield

Posted in Budgets, Legislature, State