| Ask DLS: Property Tax Incentive and Financing Program Changes

This month’s Ask DLS features questions relating to changes in economic and housing development property tax incentives and financing programs under the Job Creation and Workforce Development Act, Chapter 219 of the Acts of 2016, and the Municipal Modernization Act, Chapter 218 of the Acts of 2016. A summary of the changes made by the Municipal Modernization Act can be found in the August 18, 2016 issue of City & Town. We have also compiled the questions answered in the Municipal Modernization Act series of Ask DLS for your convenience. Please let us know if you have other areas of interest or send a question to cityandtown@dor.state.ma.us. We would like to hear from you.

What is the District Improvement Financing Program?

Under MGL c. 40Q, cities and towns may create one or more improvement districts within their boundaries to promote increased residential, industrial, and commercial activity. Development districts are created by action of the mayor and council in cities, and town meeting in towns.

The centerpiece of the district improvement financing (DIF) program is the “District Development Program,” which is a statement of means and objectives designed to improve the quality of life, the physical facilities and structures and the quality of pedestrian and vehicular traffic control and transportation within a development district. Development programs may also include means and objectives to increase residential housing, both market rate and affordable. Every development program must include a financial plan, which is a statement of the costs and revenue sources needed to carry out development programs, to include (1) cost estimates for the development program; (2) the amount of indebtedness to be incurred; and (3) sources of anticipated capital. MGL c. 40Q, sec. 2.

How is municipal financing of improvements under the DIF program different than financing of other improvements?

A unique financing option involves setting aside all or a portion of the additional taxes, generated by the public improvements entailed in the development program. Districts that set aside a portion of the rise in property tax revenues (the “increment”) to finance the development program are referred to as “invested revenue districts.” General obligation or revenue bonds can be issued in anticipation of higher property tax revenues spurred by the development program in the district.

The revenue from the retained tax increment is reserved and credited to two accounts. MGL c. 40Q, sec. 3. First in priority is the “development sinking fund account” that is used to cover payment of interest and principal on debt taken out to fund the program. Second priority goes to a “project cost account” to cover separate project costs as outlined in the financial plan for the program. An amendment made by the Municipal Modernization Act provides that the requirement to reserve the increment ends when sufficient monies have been reserved to cover the full, anticipated liabilities of both these accounts. MGL c. 40Q, sec. 3(d).

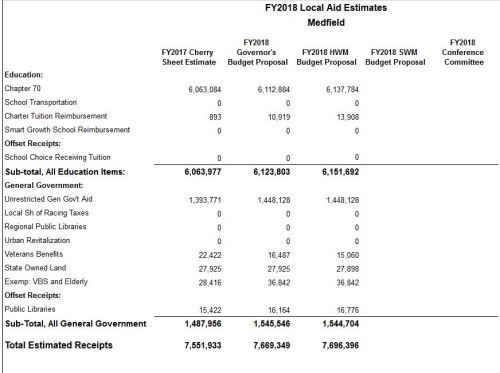

How is the District Improvement Financing tax increment calculated?

The Municipal Modernization Act amended the calculation of the tax increment reserved for debt service and project costs in cities and towns with invested revenue districts under MGL c. 40Q. It will now equal the actual new growth increase added to the municipality’s levy limit under Proposition 2½ for the development activity and expanded tax base within the district. MGL c. 40Q, sec. 1. The previous formula was based on certain adjusted valuation increases that were difficult to calculate, did not correspond to the new property tax revenue generated by the program and were not fixed until the tax rate for the year was set. The amount will now be known before the rate is set since it is based on Proposition 2½ new growth. Moreover, the assessors can provide a realistic estimate of the increment for budgeting purposes. This will ensure that the revenues generated by the increment are not used to support the budget generally.

The annual increment is based on the increase in the community’s levy limit (“new growth”) attributable to real estate parcels within the district for that year, including the portion attributable to prior years with an assessment date after the base date of the program. The percentage of the increment being reserved for financing the project must be specified as part of the district financing plan.

Example

District is created April 1, 2017

Base date is January 1, 2017 (FY18)

FY19 with January 1, 2018 assessment date is first year for tax increment

$100,000 of FY19 tax base growth is attributable to parcels in district

FY19 increment = $100,000.

$150,000 of FY20 tax base growth is attributable to parcels in district

FY20 increment = $252,500 [$102,500 ($100,000 FY19 increment increased by 2.5%) PLUS $150,000 additional increment]

$100,000 of FY21 tax base growth is attributable to parcels in district

FY21 increment = [$358,813 [$258,813 ($252,500 FY20 increment increased by 2.5%) PLUS $100,000 additional increment]

Where can municipalities enter into TIF Agreements?

The Job Creation and Workforce Development Act, Chapter 219 of the Acts of 2016, made a number of changes in the economic development incentive program (EDIP), which makes state tax credits and local property tax exemptions available for certain economic development projects. MGL c. 23A, secs. 3A–3G. The EDIP program is administered by the state Economic Affairs Coordinating Council (EACC), which approves the tax incentives. The Act streamlined the requirements and procedures for the two local property tax exemptions under the program, which are the tax increment financing (TIF) exemption and the special tax assessment (STA).

Municipalities may now apply to the EACC to declare an area in their city or town, or contiguous areas in neighboring cities or towns, as eligible for TIF agreements. An area can be designated as TIF-eligible if the EACC finds that there is a strong likelihood that any of the following will occur within a specific and proximate period of time: (1) a significant influx or growth in business activity; (2) creation of a significant number of new jobs—not merely replacement or relocation of current jobs within the state; or (3) a private project or investment will contribute significantly to the resiliency of the local economy. It is no longer necessary that a TIF-eligible area be within an Economic Target Area (“ETA”).

Cities and towns can enter into TIF agreements with persons or entities undertaking either (1) certified projects, or (2) real estate or facility expansion projects in a TIF-eligible area. Any project must be consistent with the municipality’s economic development objectives and likely to increase or retain employment opportunities for residents of the municipality. MGL c. 23A, sec. 3E. A certified project is a project run by a business for which the EACC has approved state tax incentives. An eligible real estate project must be construction, rehabilitation or improvement of any building or other structure on a parcel of real property which, when completed, will result in at least a 100% increase in the assessed value of the real property over the assessed value of the real property prior to the project. A facility expansion project requires relocation from one location to another in the state or expansion of an existing facility that results in a net increase in the number of full-time jobs at the relocated or expanded facility. See definitions in MGL c. 23A, sec. 3A.

What happens to a local tax incentive for a certified project when the certification is revoked?

The 2016 Act clarified the impact of an EACC revocation of a certified project for a business that is also receiving a local tax incentive. MGL c. 23A, sec. 3F. The EACC can revoke state tax credits for certified projects that are in material non-compliance with the job creation or other requirements agreed to as a condition of the credits. The local tax incentive will now terminate at the beginning of the tax year in which the material non-compliance occurred, unless the agreement between the municipality and business expressly provides otherwise. If a local tax incentive is terminated, the municipality may amend the agreement to continue it. The amended agreement must be approved by the legislative body and EACC. In addition, the municipality may recapture the previously foregone taxes by making a “special assessment” on the taxpayer in the year after the year of the EACC’s decision to revoke project certification. The recapture could go as far back as the finding of material non-compliance. The procedure for municipalities to assess and collect the recaptured amount as a property tax is also spelled out.

What is the new local option to promote creation of middle income housing? (Republished from March 2, 2017 City & Town)

Under G.L. c. 40, sec. 60B, cities and towns may, through their respective legislative bodies, provide for Workforce Housing Special Tax Assessments (WH-STA’s) as incentive to create middle-income housing. Municipal Modernization Act, Chapter 218, sec. 39 of the Acts of 2016. Unlike other property tax incentives, such as economic development tax increment finance (TIFs) agreements, no state-level approval is required. Local WH-STA plans may allow for exemptions as great as 100% of the fair cash value of the property during the first two years of construction. Over a three-year stabilization phase following construction, the exemptions are available in declining maximum percentages of the fair cash value.

To use this incentive, a city or town must designate one or more areas that present exceptional opportunities for increased development of middle income housing as WH-STA zones. The plan must describe in detail all construction activities and types of residential developments intended for the WH-STA zone. The city or town must also promulgate regulations establishing eligibility requirements for developers to enter into WH-STA agreements. The regulations must address procedures for developers to apply for a WH-STA; the minimum number of new residential units to be constructed to qualify for WH-STA tax incentives; maximum rental prices and other eligibility criteria to facilitate and encourage construction of workforce housing.

The city or town may then enter into tax agreements with property owners in WH-STA zones that will set maximum rental prices that may be charged by the owner to create middle income workforce housing. |