Email from Mike Webber, Chair, School Building Committee –

========================================================

All,

See link below. Medfield is NOT on the Agenda.

This came today in my e-newletter from the Division of Local Services (DLS) at the Massachusetts Department of Revenue to explain what the Gov’s administration thinks are the highlights of her first budget.

| Partnering with our Cities and Towns – FY24 Funding Updates Secretary Matthew J. Gorzkowicz – Executive Office for Administration & Finance FY24 Budget On Wednesday, August 9, Governor Healey signed the FY24 budget, representing $55.98 billion in historic investments in schools, child care, workforce development, public transit, housing, climate resiliency and other key areas that will help make Massachusetts more affordable, competitive, and equitable. In collaboration with our partners in the Legislature, the budget includes hallmark proposals from Governor Healey, including making community college free for students aged 25 and older through MassReconnect, expanding Commonwealth Cares for Children (C3) grants for early education and care providers, increasing funding for Early College, Innovation Career Pathways, apprenticeships and other workforce development programs, and dedicating 1 percent of the budget to energy and the environment for the first time. Through the FY24 budget, the Healey-Driscoll Administration is reaffirming our commitment to the state’s partnership with cities and towns, making historic investments in Chapter 70 school aid, unrestricted government aid, and student transportation. This spending plan fully funds another year of the Student Opportunity Act and dedicates resources to help cities and towns redevelop and revitalize their downtowns. In total, cherry sheet aid to municipalities across the Commonwealth is increasing $648 million, or 8.4%, over FY23, totaling $8.37 billion. With this being the administration’s first budget, we are excited to share some of the details on our support for cities and towns. Unrestricted General Government Aid (UGGA) A cornerstone of the administration’s commitment to partnering with municipalities is the expansion of Unrestricted General Government Aid, supporting essential local government services, including public safety, public works, and economic development. In FY24, UGGA is increasing by $39 million, or 3.2%, over FY23, totaling $1.27 billion. Education: Fully Funding the Student Opportunity Act The administration is focused on ensuring that all students have access to a high-quality public education. In FY24, Chapter 70 aid is increasing by $594 million, or 9.9%, over FY23, totaling $6.59 billion. This represents full funding of the Student Opportunity Act, the largest nominal increase in the history of the program, and the largest percentage increase in more than two decades. The budget also funds major increases in school transportation reimbursement ($21.3 million, 20%) and rural school aid ($9.5 million, 173%). It includes full funding for Special Education Circuit Breaker. FY24 also includes funding to make universal school meals permanent, ensuring every student across the Commonwealth has access to healthy nutrition during the school day. For school buildings, the FY24 budget includes $50 million for the new Green School Works program, providing grants to school districts for clean energy infrastructure, $100 million in supplemental grants to mitigate cost increases at school construction projects previously funded by the MSBA and an increase in the MSBA’s statutory cap to $1.2 billion. Municipal Partnerships The FY24 budget also includes funding for critical partnership programs between municipalities and the state. Some examples include: Increasing payments in lieu of taxes (PILOT) for state-owned land by $6.5 M (14%). Increasing funding for public libraries by $3.8 million (12%). $100 million in supplemental aid for municipal road and bridges, funded by Fair Share surtax revenues. $16.3 million in funding for the Municipal Regionalization and Efficiencies Incentive Reserve, which funds programs including the Community Compact’s Best Practice ($2.1 million) and Efficiency and Regionalization Grant ($600,000) programs. $600,000 for the Massachusetts Downtown Initiative for municipalities looking to revitalize their downtowns. FY24-FY28 Capital Investment Plan On June 22, the Healey-Driscoll Administration released its first five-year Capital Investment Plan (CIP), outlining more than $14 billion in investments over five years to build a more affordable, competitive, and equitable future for Massachusetts. The investments in the FY24-FY28 CIP complement and build on the funding proposed in the administration’s inaugural operating budget, with a particular emphasis on advancing climate, economic development, and housing goals – including the creation of a new $97 million HousingWorks program. For municipalities, the CIP includes significant funding for transportation, economic development, climate initiatives, technology infrastructure, and more. Transportation FY24 investments in transportation infrastructure across our cities and towns include: $200 million for Chapter 90 local transportation projects $25 million for the Municipal Pavement Program $15 million for the Municipal Small Bridge Program $15 million for the Complete Streets Program $8.5 million for the Shared Streets and Spaces Program $6 million for the Local Bottleneck Reduction Program Economic Development The Healey-Driscoll Administration is committed to working with local leaders to build vibrant communities, revitalize downtowns, and create economic opportunity for all Massachusetts residents. In FY24, investments through the CIP include: $96 million for MassWorks infrastructure grants $16.6 million for Revitalizing Underutilized Properties $5 million for the Rural and Small Town Development Fund Climate Withstanding the climate crisis and protecting our environment requires a strong partnership between the state and local communities. The FY24 CIP continues investments in EEA’s programs that support communities as they plan for the future, including: $41.2 million for the Clean Water Trust Revolving Fund $23.7 million for the Municipal Vulnerability Program (MVP) $21 million for Community Investment Grants $12 million for Inland Dams and Seawalls $10 million for MassTrails grants to municipalities Technology Ensuring that all municipalities have the necessary technological infrastructure is critical for growth throughout Massachusetts. The FY24 CIP invests: $6.5 million for the Broadband Middle Mile Program $5 million for the Community Compact Municipal Fiber Grant Program $5 million for Community Compact Information Technology Grants $1 million for the Broadband Last Mile Program Other Municipal Funding $25 million for Library Construction Grants $10 million for Cultural Facilities Fund Grants $4 million for Municipal ADA Improvement Grants $1.6 million for Historic Preservation Grants We remain committed to working with our municipal partners in support of your efforts to make our Commonwealth stronger for all. Thank you for your dedication and hard work! For more information on the FY24 budget, please visit www.mass.gov/gaa. For more information on the FY24-FY28 Capital Investment Plan, please visit www.mass.gov/capital. Register Today for the 2023 “What’s New in Municipal Law” Seminars The Division of Local Services Municipal Finance Law Bureau will offer its annual “What’s New in Municipal Law” seminars for local officials on Thursday, September 21, 2023 at the Bentley University Conference Center in Waltham and Thursday, September 28, 2023 at the Log Cabin Banquet & Meeting House in Holyoke. The seminars will be held in-person and run from 9am to 3pm. The registration fee is $100. Payment must be received by Friday, September 15th. Event check-in opens at 8:15am. Lunch will be provided. To view the registration form, please click here. Any questions regarding the seminars should be directed to dlsregistration@dor.state.ma.us. Highly Recommended: Formal Financial Policies The DLS Financial Management Resource Bureau (FMRB) provides tailored consultative services to municipalities across the state. Articles in this series highlight a particular financial management best practice that we frequently recommend. The adoption of formal financial policies is a best practice that serves many important purposes. Among the most crucial of these is the directive guidance that fiscally prudent policies provide for achieving sound, long-term budgeting practices. Along with a capital improvement plan and long-range forecast, financial policies constitute one of the three key tools that DLS encourages all communities to employ to shape the development of annual budgets that are balanced and sustainable into the future.  At a basic level, a policy constitutes a high-level plan for achieving certain goals within a defined topic area. In municipal government, financial policies can be divided into two broad categories. Fiscal planning policies present a roadmap to guide short- and long-term budget decisions. When they are well-reasoned, such policies help mitigate the risk of developing any structural imbalances while also providing a framework for sustaining and enhancing services. As the other category, financial operations policies promote accountability and enhanced coordination of services by defining procedural objectives and the related responsibilities assigned to applicable municipal officials and employees. Financial policies should be understood as a foundational component of the government’s larger system of internal controls and are themselves a form of internal control of the directive variety. It is because of this vital function that credit rating agencies such as Moody’s and Standard & Poor’s look favorably upon the presence of strong formalized policies when determining a community’s bond rating, which has a significant impact on the cost of borrowing. The effort to research, discuss, write, review, and finally adopt policies can seem a daunting task. As a result, many communities, especially smaller towns, have only informal and often unwritten guidelines that might only be passed along in an ad hoc fashion as local officeholders enter and leave municipal service. Such municipalities have a more tenuous hold on institutional knowledge and are also liable to be relatively myopic or disjointed in the pursuit of their goals. Hence, a prime objective for adopting formal, written policies is to serve as an educational tool that can foster long-term consistency and continuity in operational and budgeting practices. Furthermore, enhanced transparency in fiscal governance can be achieved through policy adoption, and we encourage cities and towns to incorporate fiscal policy text into their budget documents and presentations. While remaining more flexible and easier to modify than bylaws and ordinances, policies should provide instructive guidance to steer officials and employees toward objectives. To assure effectiveness, city and town officials must be thoughtful and proactive in promoting policy awareness within the organization. We also recommend communities to periodically review and revise their policies to address evolving goals and circumstances. From the financial management reviews and other municipal project work that FMRB has done over the years, the bureau has identified a minimum set of core policies we believe every city or town should adopt to manage the most significant areas of budgetary and operational risk. These are listed in the table below.  FMRB has drafted 30+ policy manuals for cities and towns, each of which incorporates the above topics, as well as others desired by the client community. Any municipality that is conducting research to create or revise a policy manual may access them here. |

Comments Off on State explains Gov’s first budget

Posted in Budgets, Financial, Legislature, State

Comments Off on State updated our FY24 aid by $2K

Posted in Budgets, Financial, Legislature, State

The state budget was finally agreed upon by the legislature this week (a month into the fiscal year and long after the town had to set its own budgets at the annual town meeting (ATM) at the beginning of May).

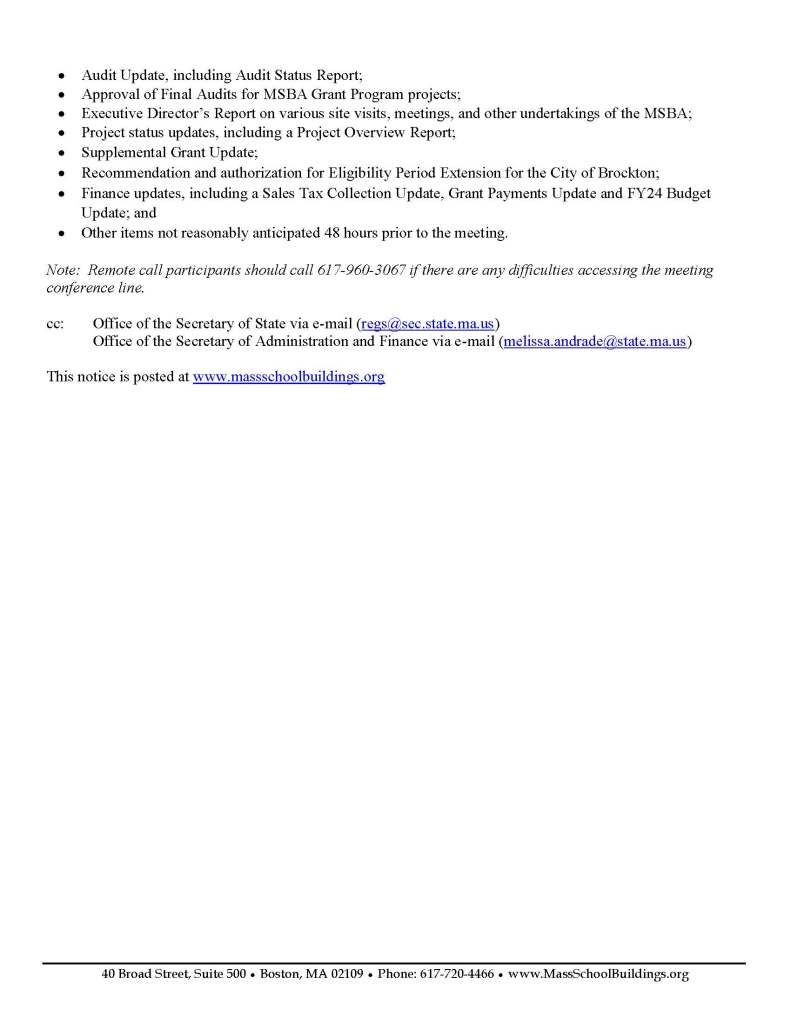

The following are the Town of Medfield state aid amounts for FY24 that were just released – our state aid is $8,550,556, up $166,430 over FY23 (the last fiscal year):

Comments Off on State aid to Medfield up $166K (2%)

Posted in Budgets, Financial, Legislature, State

Email this afternoon from Town Administrator, Kristine Trierweiler –

We have submitted the FY2023 budget to GFOA (Government Finance Officers Association) today seeking a distinguished budget award. The document has also been posted on the Town’s website:

https://www.town.medfield.net/DocumentCenter/View/6594/Medfield-FY2023-Annual-Budget

—

Kristine Trierweiler Town Administrator

Comments Off on Medfield’s ARPA Allocation = $3.796m.

Posted in Budgets, COVID-19, Federal Government, Financial

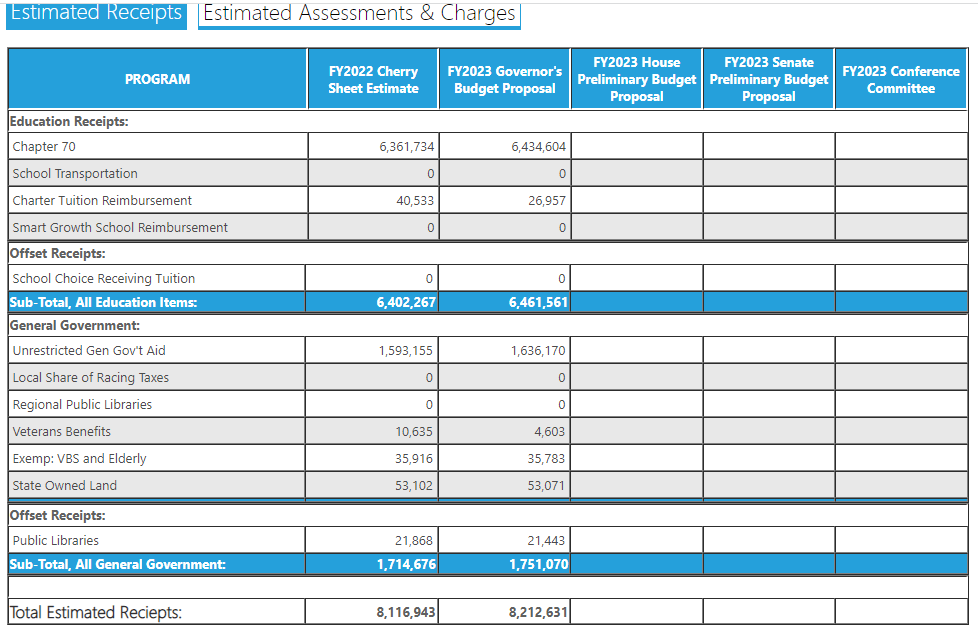

See the town Cherry Sheet for FY2023 here – https://dlsgateway.dor.state.ma.us/reports/rdPage.aspx?rdReport=CherrySheets.CSbyProgMunis.MuniBudgFinal

FY2022 we got $8,116,943 from the state

FY2023 we will get $8,384,126, or $267,183 more (a 3.2% increase).

This alert below came this afternoon from the Massachusetts Municipal Association –

|

| Governor Signs FY23 Budget Supports Key Municipal Aid and School Funding And Offers Amendment to Important Retiree COLA Language Please Thank Your Legislators and Ask Them to Accept the Governor’s Amended COLA Language July 28, 2022 Dear Osler L. Peterson, This morning, Governor Baker signed a $52.7 billion budget, including each of the increases in municipal and school aid accounts for which the MMA has prioritized throughout the process. The Governor also signed 153 of 194 of the outside sections of the budget and has returned a key section with an amendment for the Legislature’s consideration. As enacted by the Legislature, Outside Section 134 would allow retirement boards that have accepted Section 103 of Chapter 32 to award a cost-of-living-adjustment of up to 5% to retirees, rather than the current limit of up to 3%. In response to concerns voiced by the MMA, specifically related to the lack of decision-making authority on a potentially large expense for municipal budgets, the Governor returned this section with amended language (for the full language, see Attachment S, Returned with Amendments, Section 134). The amended language provides that if a local or regional retirement board chooses to adopt this provision, municipalities would have the authority to accept or reject its decision. There is further clarifying language regarding situations that involve a county retirement board with more than one participating municipality. For those regional systems, 2/3rds of the participating municipalities would need to approve the higher COLA. In addition, the Governor’s amended language would provide important clarification that the potential 3-5% increase would apply only on the approved base, not the entire pension. This would eliminate some lack of clarity in the current language. The Governor’s amendments would provide critical municipal oversight for this costly provision. The provision now returns to the Legislature, which can accept the Governor’s proposed amendment, insist on its original language, or propose different language. If the Legislature insists on its own language, or proposes different language, the provision would return to the Governor, who would have 10 days to sign or veto the provision. With formal legislative sessions ending on July 31, a veto after that date would kill the provision, an outcome that is unlikely, since the Governor is likely to support a 5% COLA for state retirees. Please contact your legislators and ask them to accept the Governor’s amendments to Section 134 (via Attachment S). Please also be sure to thank your legislators again for the important and significant increases in key accounts for municipal and school funding, all of which were included in the budget signed by the Governor: $63 million (5.4%) increase in Unrestricted General Government Aid, for a total of $1.23B, which is $31.5 million more than originally proposed Nearly $6B for Chapter 70 School Aid, Including doubling the increase for minimum aid districts from $30 per pupil to $60 per pupil $440M for Special Education Circuit Breaker, an increase of $67M from FY22 $5.5M for Rural School Aid $45M for PILOT for state-owned land, a 29% increase from FY22 $20M transfer from FY22 surplus for the Community Preservation Trust Fund If you have any questions, please contact MMA Legislative Director Dave Koffman at dkoffman@mma.org or MMA Senior Legislative Analyst Jackie Lavender Bird at jlavenderbird@mma.org. Please Call Your Legislators Today to Thank Them for their Support of Key Local Accounts and Ask Them to Accept the Governor’s Proposed Language Regarding the Retiree COLA Provision Thank You!! |

Email today from the Massachusetts Municipal Association –

• LEGISLATURE’S BUDGET INCREASES UNRESTRICTED GENERAL GOVERNMENT AID BY $63M (5.4%) – A WIN FOR CITIES AND TOWNS!

• INCREASES CHAPTER 70 BY $485.2M ABOVE FY22, FUNDING THE STUDENT OPPORTUNITY ACT ON ITS ORIGINAL (PRE-COVID) SCHEDULE

• DOUBLES NEW FUNDING TO MINIMUM AID DISTRICTS TO $60 PER STUDENT

• INCREASES CHARTER SCHOOL REIMBURSEMENTS BY $89.2M

• INCLUDES $441M TO FUND THE SPECIAL EDUCATION CIRCUIT BREAKER

• ADDS $10M TO PILOT, BRINGING THE PROGRAM TO $45M

• INCLUDES $5.5M FOR RURAL SCHOOL AID

• INCLUDES $82.1M FOR REGIONAL SCHOOL TRANSPORTATION

• ADDS $20M TO STATE’S COMMUNITY PRESERVATION ACT MATCH

OTHER BREAKING NEWS: REMOTE MEETING EXTENSION BILL SIGNED INTO LAW BY LT. GOV. POLITO ON SATURDAY – Cities and towns now retain the option to hold public meetings remotely through March 31, 2023, following the same guidelines that have been in place since the COVID public health emergency was first declared. With Gov. Baker out of state over the weekend, Lt. Gov. Polito (as Acting Governor) signed the bill, which took effect immediately. MMA pushed hard for this extension, and successfully advocated against attempted amendments that would have burdened communities with unfunded mandates.

July 18, 2022

Dear Osler L. Peterson,

Last night, Sunday, July 17, the fiscal 2023 state budget conference committee released H. 5050, the House-Senate compromise budget bill. The House and Senate have scheduled formal sessions for Monday, July 18, and both chambers are expected to pass the measure at that time. The Governor will then have 10 days to approve the spending appropriations and proposed law changes, veto, or return any items with amendments. That will give lawmakers several days to consider overriding any vetoes before formal sessions end on July 31.

Following months of state tax collections exceeding expectations, the $52.7 billion fiscal year 2023 state budget plan reflects an agreement between Senate and House leaders to increase tax collection estimates for fiscal year 2023 by $2.66 billion, with $1.9 billion available for the general budget after statutorily required transfers. As a result, all key local aid accounts received the higher funding levels in areas where the Senate and House needed to resolve differences.

In a major win for cities and towns, the Legislature’s budget bill increases Unrestricted General Government Aid (UGGA) by $63 million (5.4%), a major priority pushed by MMA throughout the budget deliberations. This will double the municipal aid increase originally proposed by the Governor in January. In addition, the budget would also significantly increase Chapter 70 school aid over fiscal year 2022, bringing the total to nearly $6 billion. The budget includes a $67 million increase for Special Education Circuit Breaker, an additional $89 million for Charter School Mitigation payments, and an increase of $10 million for Payments-in-Lieu-of-Taxes for state-owned land (PILOT).

You can find the Chapter 70 and UGGA amounts for your community in Section 3 of H. 5050, beginning on page 302 of the downloadable PDF (see the link below this line).

Click Here for a Link to the Legislature’s Budget

Unrestricted General Government Aid (UGGA)

In a major win for local government, the conference committee report includes $1.23 billion for Unrestricted General Government Aid (line item 1233-2350 and section 3), an increase of $63 million, or 5.4%, over the fiscal 2022 level of funding, which is double the $31.5 million increase originally proposed by the Governor in January. Increasing UGGA has been a key MMA priority throughout the process. With property taxes tightly capped by Proposition 2½, cities and towns rely on state revenue sharing to provide municipal and school services, ensure safe streets and neighborhoods, and maintain vital infrastructure. These services are fundamental to our state’s economic recovery, success and competitiveness. Unrestricted General Government Aid is the revenue sharing program that cities and towns receive to fund essential municipal services.

Chapter 70

The Legislature’s budget would fund Chapter 70 aid at nearly $6 billion, representing a commitment to fund the Student Opportunity Act (SOA) according to the original intended schedule, a solid achievement given the initial disruption caused by COVID’s economic disruption. In addition to keeping the commitment to fund the SOA, the Legislature recognized the challenges facing 135 “minimum aid” districts that would have received only a $30 per student increase over the previous year under the budget filed by the Governor in January. MMA applauds the Legislature for doubling the minimum aid increase to $60 per student.

Special Education Circuit Breaker

H. 5050 provides $441 million for Special Education Circuit Breaker (7061-0012), which reimburses school districts for the high cost of educating students with disabilities. This amount reflects an increase of $67 million over the current fiscal year. The Student Opportunity Act expanded the circuit breaker by including out-of-district transportation, to be phased in over three years. The fiscal 2023 budget reflects years two and three of the schedule in the Student Opportunity Act, achieving full funding one year ahead of schedule.

Charter School Mitigation Payments

To address charter school mitigation payments, H. 5050 includes $243 million for charter school mitigation payments (7061-9010), which represents an increase of $89.2 million over the current fiscal year. This funds the state’s statutory obligation for charter school mitigation payments as outlined in the Student Opportunity Act, pushing the state to phase in the plan by fiscal 2023, a full year ahead of schedule.

School Transportation

The Legislature’s budget level funds regional school transportation at $82.1 million, representing a reimbursement rate of 85% of DESE’s estimated costs for FY23. H. 5050 fully funds the McKinney-Vento account for transportation of homeless students at $22.9 million, and level funds out-of-district vocational transportation at $250,000.

PILOT Funding

Recognizing the importance of Payments-in-Lieu-of-Taxes (PILOT) for state-owned land, H. 5050 increases the line item to $45 million (a $10 million increase over fiscal year 2022). This has been a key priority for many years. Low PILOT funding has created a significant hardship for smaller communities with large amounts of state-owned property, and this 29% increase is very welcome news, and will provide an important boost.

Rural School Aid

Rural School Aid (7061-9813) is funded at $5.5 million in H. 5050, providing rural school assistance to eligible towns and regional school districts. These grants will help schools facing the challenge of declining enrollment to identify ways to form regional school districts or regionalize certain school services to create efficiencies.

Outside Section – Retiree COLA Provision

Section 134 of the budget would allow retirement boards that have accepted Section 103 of Chapter 32 to award a cost-of-living-adjustment of up to 5% to retirees, rather than the current limit of up to 3%. While MMA appreciates the concern driving this provision, we opposed this section due to the potential negative impact on unfunded pension liabilities. Most communities in the state participate in regional pension systems, and do not have direct decision-making authority regarding adoption of a higher COLA. Adoption of a higher COLA, even if limited to one year, would permanently increase the pension obligations for all participating communities, requiring increased annual appropriations to fund the cost. We encourage local officials to contact their retirement boards to discuss the financial implications of adopting a higher COLA for fiscal 2023.

Outside Section – Community Preservation Act

Section 174 of H. 5050 directs the comptroller to transfer $20 million of the fiscal year 2022 budget surplus to the Massachusetts Community Preservation Trust Fund. This provision would increase the state’s match from an estimated 35% to 43%, approximately the same state match percentage as fiscal year 2022. The number of CPA communities has reached 187, and this budget item will benefit cities and towns that have adopted higher local property taxes to address environmental and housing challenges.

THE LEGISLATURE’S BUDGET IS GOOD NEWS FOR CITIES AND TOWNS

Please call your Representatives and Senators and thank them for the important and much-appreciated municipal and school investments that are included in the Legislature’s budget bill. This has been a tumultuous time for state and municipal finances, and the Legislature is advancing a spending plan that invests in communities, which is much appreciated.

If you have any questions or need additional information on any municipal aid priority, please contact MMA Senior Legislative Analyst Jackie Lavender Bird at 617-426-7272 ext. 123 or jlavenderbird@mma.org.

Massachusetts Municipal Association

3 Center Plaza

Suite 610

Boston, MA 02108

(617) 426-7272 | Email Us | View our website

Unsubscribe from MMA Legislative Alert Emails

Comments Off on MMA on state budget – more for Medfield

Posted in Budgets, Financial, Legislature, State

From the Massachusetts Municipal Association this afternoon –

Comments Off on State budget – Gov.’s version – town share up $96K

Posted in Budgets, Financial, Legislature, State