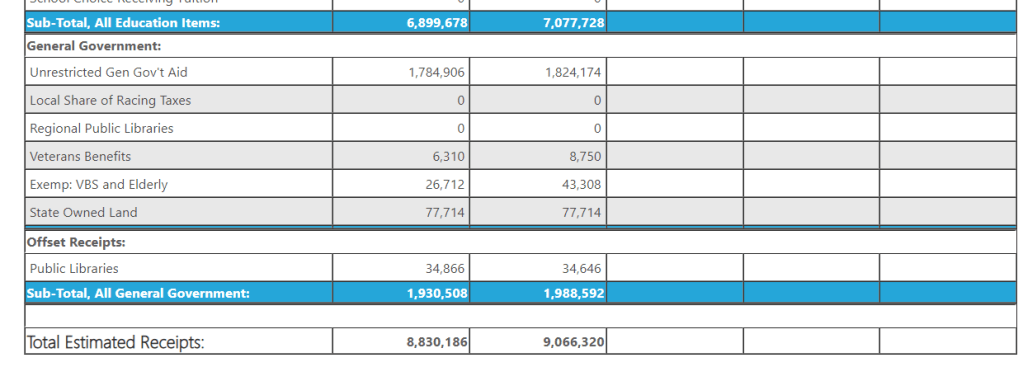

DRAFT CHERRY SHEETS – legislature proposes level funding UGGA (state aid – line 21 below)

Follow up today from MASSterList on CDC $ Feds cut –

|

CDC pulls COVID response grants

The U.S. Centers for Disease Control and Prevention pulled about $11.4 billion in Covid-19 pandemic response grants allocated to state and community health centers on Wednesday. The Department of Health and Human Services said the agency will “no longer waste billions of taxpayer dollars responding to a non-existent pandemic that Americans moved on from years ago.” In a statement released Wednesday, Gov. Healey said the grants are expected to bring nearly $100 million to Massachusetts over the next year, but that “much” of the funding has already been obligated in the state — the Trump administration is moving to eliminate the unobligated parts of the grants. Healey condemned the federal decision, calling it “yet another example of President Trump and Elon Musk undermining the health and wellbeing of the people of Massachusetts and people across this nation.”

Comments Off on More on CDC cutting already promised $

Posted in Budgets, Federal Government, health

From: Office of Local & Regional Health <localregionalpublichealth@notice.mass.gov>

Date: Wed, Mar 26, 2025 at 1:44 PM

Subject: Federal funding update | Message from DPH Commissioner Goldstein

To: <ktrierweiler@medfield.net>

| View this email in your browser Wednesday, March 26, 2025 Dear Colleagues, I know that many of you have heard from colleagues or from media reports that the Centers for Disease Control and Prevention has notified state departments of public health — including the Massachusetts Department of Public Health — about the termination of multiple COVID-19 related federal awards. Obviously, this news is troubling. We rely on these funds to carry out important ongoing work at the Department and with our partners in the community. These resources fund our state lab, supplement our statewide vaccine infrastructure, and provide the support needed for community-based organizations across the state. These are more than just COVID-19 awards; they represent investments in the core functions of public health. We are working quickly to analyze the fiscal and operational impacts of these abrupt terminations. We are also in close contact with our colleagues in the Healey-Driscoll Administration to consider what we might be able to do to mitigate the impacts, recognizing that we do not have the state resources to replace these federal funding sources. We are still sorting through the implications of these sudden terminations and do not have all of the answers. Still, I think it is important for you to know where we are given the potential impacts on our work, our community partners, and our colleagues. We will share additional information about the short-term and longer-term impact of these announcements when we know more. With gratitude, Robbie Goldstein, MD, PhD (he/him) Commissioner, Massachusetts Department of Public Health If you have any comments, questions, or feedback, please email: localregionalpublichealth@mass.gov Office of Local & Regional Health Massachusetts Department of Public Health 67 Forest Street Marlborough, MA 01752 (617) 753-8018 Visit our website! Follow DPH on X (formerly Twitter) |

Comments Off on MDPH Notice of CDC Abrupt Cuts of $ that Supported Community Based Organizations – Local DOGE Effect?

Posted in Budgets, Federal Government, health

From Steve Callahan, Co-chair of the Warrant Committee today –

Dear Medfield Budget Makers and Elected Officials

Update

This email will serve as a brief update to our December 11, 2024 communication to budget makers on the Department FY 2026 Operating Budget targets. The Warrant Committee has completed their review of the FY 2026 omnibus operating budget (forecasted revenues and shared/fixed costs) and voted at our meeting on February 26, 2025 to bring forward to Town Meeting an FY 2026 Operating Budget within the Prop 2 ½ framework.

This final FY 2026 Operating Budget (attached below) allows for a maximum increase in aggregate FY 2026 appropriations/expenditures for school and town departments of 3.4% and 3.5%, respectively over their FY 25 approved budgets.

A host of net unfavorable factors required a decrease in previously provided targets. The most significant matter was the recently updated estimate of health insurance costs from MIAA for active and retired employees of Medfield school and town departments (representing a 16.92% rate increase).

Accordingly, the FY 2026 Operating Budget brought forward by the Warrant Committee to the Town Meeting will allow for an aggregate limit on any increases in the FY 2026 school and town departments of 3.4% and 3.5%, respectively. The amount of COLA for non-contract employees who are not covered by the Collective Bargaining Agreements and salary increases as stipulated by relevant Collective Bargaining Agreements for contract employees are expected to fall within these aggregate limits. As previously communicated, any department requests above these aggregate limits are expected to necessitate a Prop 2 ½ override and supplemental budget.

The Warrant Committee looks forward to receiving final department budgets from the Superintendent, School Committee and Town Administrator on the details of their budget requests within these aggregate limits in the next couple of weeks in order to move forward with the preparation of the warrant report for Town Meeting. We remain committed to sustainable balanced budgets within the Prop 2 1/2 framework that continue to provide essential and important services, and that the Town’s overall costs and tax rate are controlled as well as possible.

Best,

Steve Callahan

This email is intended for municipal use only and must comply with the Town of Medfield’s policies and state/federal laws. Under Massachusetts Law, any email created or received by an employee of The Town of Medfield is considered a public record. All email correspondence is subject to the requirements of M.G.L. Chapter 66. This email may contain confidential and privileged material for the sole use of the intended recipient. Any review or distribution by others is strictly prohibited. If you are not the intended recipient please contact the sender and delete all copies.

Comments Off on Final Warrant Committee FY 2026 Omnibus Prop 2 1/2 Budget Guidance

Posted in Budgets, Town Meeting, Warrant Committee

Division of Local Services (DLS) figures show we have the 25th highest property taxes in the Commonwealth of Massachusetts. The numbers copied from the DLS on-line chart show that we recently got as high as 15th in the Commonwealth – in FY 2015 – and were in the top 20 for the majority of the last ten years. We pay a lot in property taxes, but at least our recent trajectory is in the right direction.

| 175 | Medfield | 2025 | 3,469,837,100 | 3,526 | 984,072 | 13,580 | 1.38 | 136,384 | 9.96 | 25 |

| 175 | Medfield | 2024 | 3,196,279,700 | 3,539 | 903,159 | 13,222 | 1.46 | 108,657 | 12.17 | 21 |

| 175 | Medfield | 2023 | 2,971,089,900 | 3,538 | 839,765 | 12,958 | 1.54 | 99,600 | 13.01 | 21 |

| 175 | Medfield | 2022 | 2,548,578,200 | 3,536 | 720,752 | 12,555 | 1.74 | 99,242 | 12.65 | 20 |

| 175 | Medfield | 2021 | 2,440,784,100 | 3,525 | 692,421 | 12,297 | 1.78 | 97,217 | 12.65 | 18 |

| 175 | Medfield | 2020 | 2,385,437,500 | 3,526 | 676,528 | 12,062 | 1.78 | 95,034 | 12.69 | 16 |

| 175 | Medfield | 2019 | 2,320,287,900 | 3,524 | 658,424 | 11,766 | 1.79 | 92,181 | 12.76 | 15 |

| 175 | Medfield | 2018 | 2,236,789,600 | 3,524 | 634,730 | 10,809 | 1.70 | 88,206 | 12.25 | 19 |

| 175 | Medfield | 2017 | 2,196,147,000 | 3,523 | 623,374 | 10,529 | 1.69 | 80,969 | 13.00 | 19 |

| 175 | Medfield | 2016 | 2,165,785,300 | 3,519 | 615,455 | 10,309 | 1.68 | 83,668 | 12.32 | 18 |

Comments Off on We Are #25 in RE Taxes

Posted in Budgets

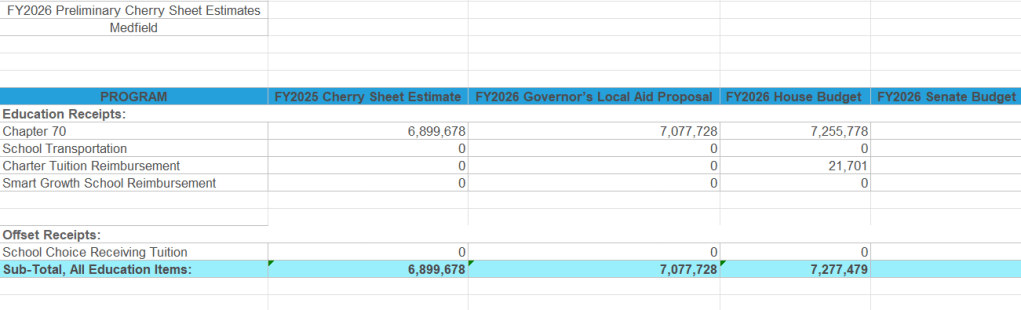

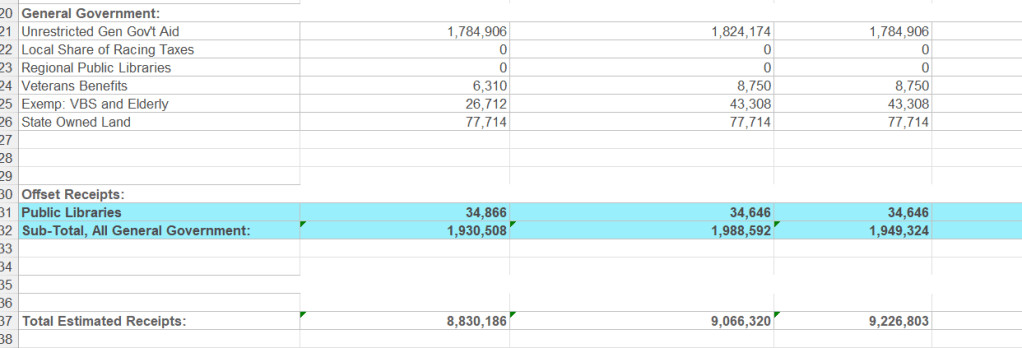

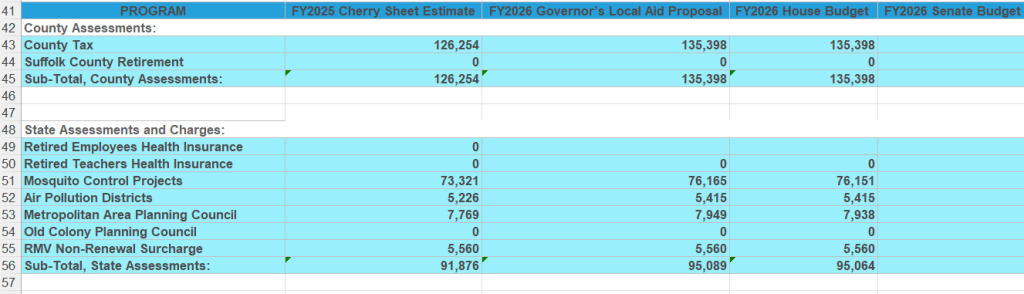

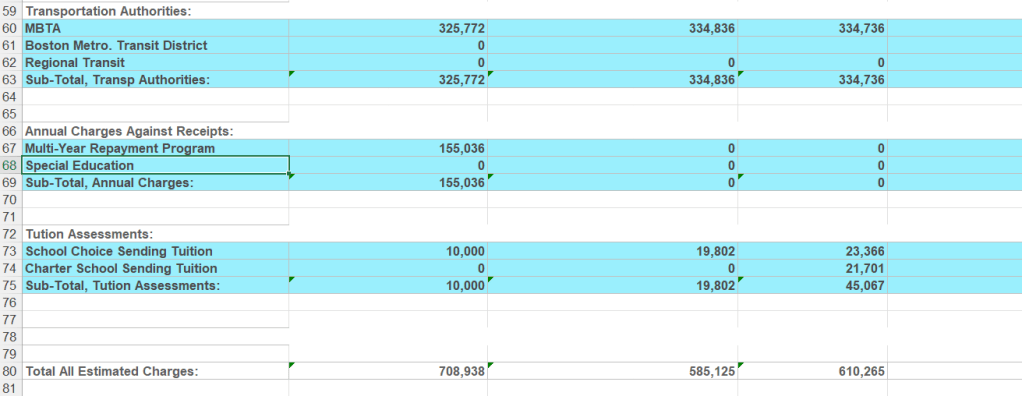

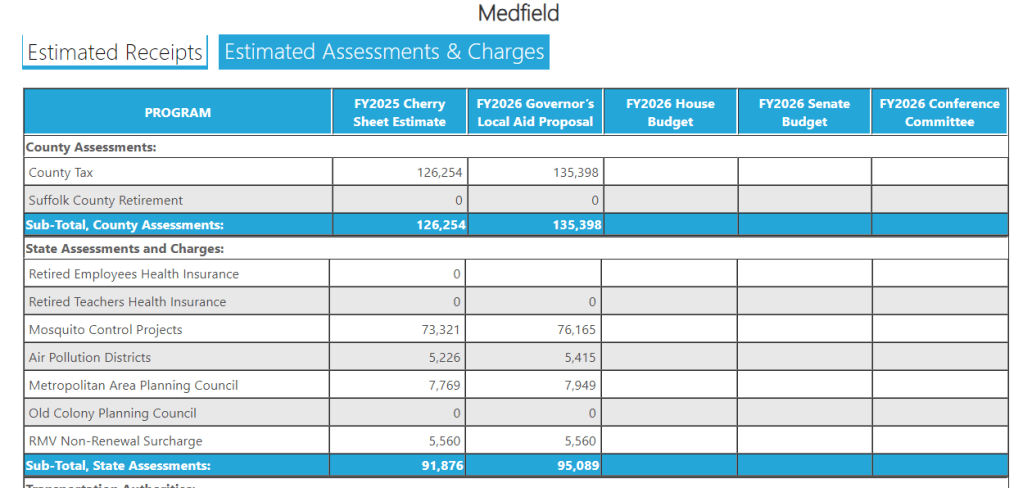

While the Gov’s proposed budget seems to allocate scant new monies for the town, we appear to have paid for the former Medfield State Hospital project on our ten year payment plan, so our assessment is down $155K.

For a detailed view of the updated information the cherry sheet websites:

Municipal estimates receipts and charges

The legislature’s earmarks process of doling out state monies in the annual state budget to good projects in each municipality is manifestly unfair and shortchanges most, yet it persists because our legislators annually adopt legislative rules that cede all power to the legislative leadership. Our legislative leadership then award/take home millions of dollars via earmarks in the annual state budget for admittedly good projects in their districts, while the bulk of districts are shortchange by getting little $$$ for their admittedly good projects.

Here is a link to a good recent Boston Globe article on the subject that details how the legislative leadership divvied up the spoils this year, and unfortunately the article is bound to make you cynical about the operation of your state government: https://www.bostonglobe.com/2024/05/09/metro/massachusetts-house-democratic-leaders-earmarks-5-million/?s_campaign=breakingnews:newsletter

By Samantha J. Gross and Matt Stout Globe Staff,Updated May 9, 2024, 5:44 a.m.

| STATE SECRETS |

After months of preaching fiscal restraint, five of the Massachusetts House’s highest-ranking Democrats slipped at least $5 million in earmarks into the chamber’s spending plan in late April, fattening their own districts’ haul far beyond that of most others and almost entirely out of public view.

Posted in Budgets, Legislature

The Massachusetts Municipal Association emailed this afternoon about what is in the House version of the budget, which was released this afternoon. The Governor proposed raising our UGGA by 3%, but the House only came through with a 1% increase. Medfield’s draft Cherry Sheet based on these House numbers will be available later this week.

In general, state aid to Medfield has been declining for years, meaning that more of what the town needs to provide for its citizens must be done with property taxes.

| House Ways & Means Committee Files $57.9B FY2025 Spending Proposal April 10, 2024 Earlier today, the House Ways & Means Committee released a $57.9 billion state budget plan for fiscal 2025. The proposal includes several important investments in schools and municipalities, despite more modest state revenue expectations than in recent years. The House Ways & Means Committee budget, H. 4600, offers important progress on a top local aid priority, by adding $37 million to lift the per-pupil minimum aid amount from $30 per student to $104. This is welcome news for 228 districts across the Commonwealth that were statutorily set to receive an increase of less than $104 per student in Chapter 70 aid funding. The HWM budget includes a 1% increase in Unrestricted General Government Aid (UGGA) over last year, lower than the 3% increase offered by the Governor. During the budget debate and legislative session, the MMA will work to build on this figure, and will continue to advocate strongly for a further increase in Unrestricted General Government Aid as well as other key municipal aid accounts. The state’s changing revenue landscape underscores the need for collective advocacy from local officials in several essential areas. The MMA will reach out in the weeks ahead with more information on critical advocacy opportunities during the House budget debate. The following are key components of the HWM proposal for municipalities: Unrestricted General Government Aid – $12.7 million increase The HWM budget includes a $12.7 million increase in the Unrestricted General Government Aid account, a 1% increase over fiscal 2024. This is below the Governor’s recommendation of a 3% increase for fiscal 2025. Chapter 70 School Aid – $308.7 million increase lifts Minimum Aid to $104 Per Student The HWM budget recommendation continues implementation of the funding schedules in the 2019 Student Opportunity Act to stay on track with the law’s intended schedule. The proposal represents funding year four of the law’s six-year rollout. In a major win for cities and towns, the House Ways and Means proposal increases per-pupil spending for Minimum Aid districts from $30 to $104 per student, leveraging surtax revenues to increase the total for Minimum Aid districts by $37 million. This would benefit the 228 out of 318 districts that were set to receive an increase of less than $104 per student for fiscal 2025. Charter School Reimbursements – $199 million The HWM budget would fund the charter school reimbursement account at $199 million, intended to meet the commitment to fund the state’s statutory obligation to mitigate Chapter 70 losses to charter schools. Rural School Aid – $7.5 million The HWM budget would fund Rural School Aid at $7.5 million for eligible towns and regional school districts. The grant program helps districts facing the challenge of declining enrollment to identify ways to form regional school districts or regionalize certain school services to create efficiencies. This amount reflects a decrease from fiscal 2024, which was funded at $15 million. Special Education Circuit Breaker – $492.2 million The HWM budget would fund the Special Education Circuit Breaker program at $492.2 million. By leveraging $75 million from a recently passed fiscal 2023 supplemental budget, total funding in fiscal 2025 would be $567 million via this proposal. Regional School Transportation – $99.4 million The HWM budget submission would fund regional transportation reimbursements at $99.4 million for fiscal 2025. According to updated cost projections from the Department of Elementary and Secondary Education, this represents an 87% reimbursement of anticipated claims. McKinney-Vento Reimbursements – $28.6 million The HWM budget would fund reimbursements for the transportation of homeless students at $28.6 million for fiscal 2025. The impact of this funding level by community will depend on the number of homeless families that remain sheltered in local hotels and motels. According to updated cost projections from the Department of Elementary and Secondary Education, the HWM proposal represents 74.4% of anticipated claims for fiscal 2025. The HWM budget does not have a line item for out-of-district vocational transportation, which was funded at $1 million in fiscal 2024. Payments-in-Lieu-of-Taxes (PILOT) – $51.8 million The HWM budget would fund PILOT payments at $51.8 million, an increase of $334,000. This amount should hold communities harmless from recent valuations. Surtax Investments Fiscal 2025 is the second year that revenue from the Fair Share amendment will be allocated. The HWM budget proposes $1.3 billion in Fair Share investments in education and transportation needs, including the following of note to municipalities: Supplemental Local Road and Bridge Funding – $25 million The HWM budget proposes an additional $25 million of surtax revenue for supplemental local road and bridge funding. This amount would be separate from the annual Chapter 90 bond authorization. This funding would be put to use immediately by cities and towns to repair crumbling local roads, advance critically needed projects, and improve safety on our neighborhood roadways. Green School Works – $10 million The HWM proposal includes $10 million for the Green School Works grant program that was launched during fiscal 2024. This program, administered through DESE, provides financial support to K-12 districts to install or maintain clean energy infrastructure. Universal School Meals – $190 million The HWM proposal includes $190 million to continue the Universal School Meals program, allowing all Massachusetts students to eat for free at school, regardless of household income. Outside Sections Disaster Relief and Resiliency Fund The HWM budget includes an outside section (Section 37) to establish a permanent Disaster Relief and Resiliency Fund, which intends to provide relief to municipalities impacted by extreme weather events. Outside Section 92 directs the state’s comptroller to transfer $14 million from any consolidated net budget surplus for fiscal 2025 to the Disaster Relief and Resiliency Fund. Creation of an iLottery, Dedicated to Early Education The HWM budget includes an outside section that would allow the Massachusetts State Lottery to create an online platform, or iLottery, with the resulting new revenue targeted to early education and care programming. While these are very worthwhile programs, they are not the intended mission of the Lottery for more than 50 years, which is to fund aid to cities and towns. Next Steps Members of the House have until 5 p.m. on Friday to file budget amendments. The House is expected to begin debate on its fiscal 2025 state budget proposal on April 24. The Senate will take up its budget process in May, with the goal of having a final bill on the governor’s desk in time for the July 1 start of the fiscal year. The MMA will continue to reach out to local officials in the weeks and months ahead to engage in advocacy efforts on behalf of many critical municipal and school aid programs. Helpful Links: The Division of Local Services will update the Preliminary Cherry Sheets to reflect the House Ways & Means proposal later this week. Click here to see the full text of the House Ways & Means budget proposal. |

Comments Off on House budget issued per MMA

Posted in Budgets, Financial, Legislature, State

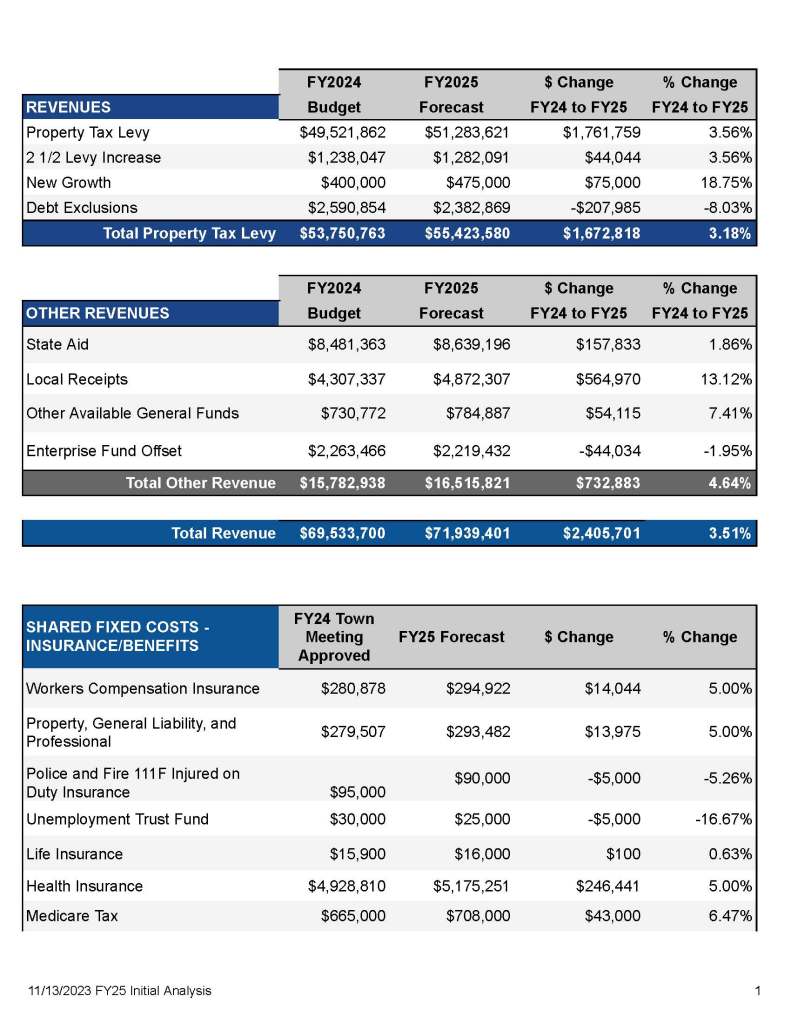

Email today from Warrant Committee Cochair, Stephen Callahan, with the Budget Guidance for the upcoming budget cycle (FY25) –

++++++++++++++++++++++++++++++++++++++++++++++++

Dear Medfield Budget Makers and Elected Officials

The Warrant Committee has implemented a new budget process this year that emphasizes upfront budget guidance for departments and elected officials and an earlier process to achieve our goal of a sustainable balanced budget within the Prop 2 ½ limits to bring forward to Town Meeting.

Last evening, we completed our due diligence on the FY 25 budget guidance and approved the attached communication to all budget makers and elected officials. In addition to providing overall budget targets for departments, it provides additional information on process, expectations, and timelines for FY 25. Feel free to reach out to me or Bob Sliney if you have any questions on these matters.

The Warrant Committee looks forward to our upcoming reviews and meetings with departments to better understand the important services and needs for the FY 25 Budget.

Please feel free to forward to others that you feel would benefit from this communication.

Hoping you all have a happy thanksgiving with your families.

Best,

Steve Callahan

+++++++++++++++++++++++++++++++++++++++++++++++

To: Medfield Budget Makers and Elected Officials

Date: November 13, 2023

From: Warrant Committee

Subject: FY 2025 Budget Guidance: Approach, Targets and Timeline

Summary and Background

A host of factors pushed up the growth rate of the Town’s budget in FY 23 and FY 24, including the inflation surge that began in mid- 2021. Fortunately, inflation has moved down from its peak last year but nonetheless, the space between our forecasted fixed expenditures and the Tax Levy allowed under Prop 2 ½ continues to be under pressure.

While the tax rate moved down in FY 23 to $15.43, average tax bills rose 3.2%, amounting to an increase of $402 on the average home in Medfield – and tax bills will move up again in FY 24. The property tax bills in Town have overall, risen about in line with the Consumer Price Index (CPI). Given the anticipated ongoing slowing in housing prices and continued budgetary strains, the tax rate is likely to face upward pressure in coming years.

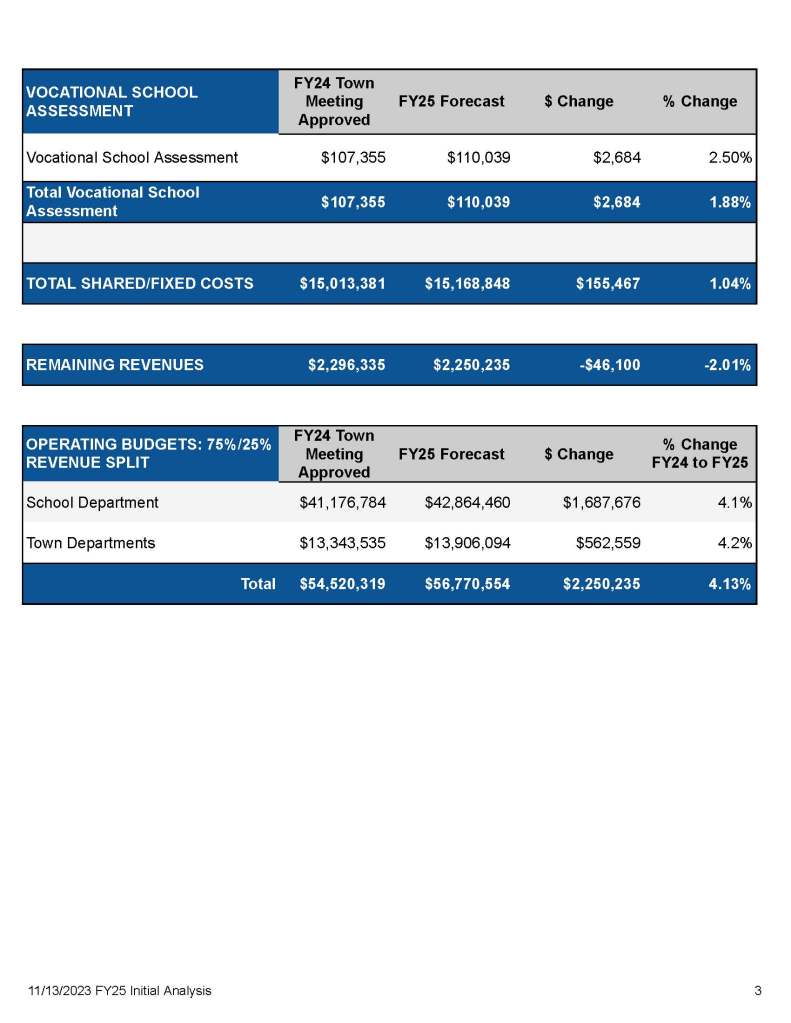

Taking all of this into account, the Warrant Committee intends to take a cautious approach to budgeting in FY 25. In summary, after a review of FY 25 forecasted revenue and fixed costs, the Warrant Committee is recommending an overall 4.1% budget guidance for school and town departments. Amounts of COLA for non-contract employees who are not covered by the Collective Bargaining Agreements and salary increases as stipulated by relevant Collective Bargaining Agreements for contract employees are expected to fall within this overall guidance.

COLA for non-contract employees (does not directly affect employees covered by Collective Bargaining Agreements)

Inflation has eroded everyone’s purchasing power since the surge that began in the middle of 2021, though inflation has moved lower recently, with the latest read on the CPI indicating that prices in the Northeast in September were 3.0 percent higher than 12 months earlier (3.7 for the US as a whole). Wages have also been rising more rapidly during this inflation environment. For example, the Employment Cost Index for State and Local governments employees rose 4.8% over the year ending in September. That figure incorporates pay increases that went into effect at the start of the fiscal year in many jurisdictions (July 1, 2023), corresponding to Medfield’s FY 24 COLA (3.0%) that also went into effect July 1st.

The COLA recommended by the Warrant Committee that will be brought forward to Town Meeting must balance the need to fairly compensate the hard work and dedication of Town employees against the burden of taxes. By way of background COLAs were 3.0 % for FY 24, 2.0 % for FY 23 and 2% for several years before that. As of this date, the Personnel Board has not decided on a COLA for FY 25.

Department Operating Budgets

As noted, budget pressures remain and are unlikely to abate in coming years. Accordingly, we ask the school and Town departments to prepare budgets that do not exceed the guidelines of 4.1% and 4.2%, respectively. Department heads should first work with the chief executives and elected boards (Superintendent/School Committee or Town Administrator/Select Board) in balancing the limitations of these guidelines with essential department needs and services in the face of unforeseen costs for essential goods and department needs. For line items where increases are necessary to maintain essential services, or where costs have increased in an out of the ordinary way, we ask budget makers to provide specific explanations to their Elected Boards and the Warrant Committee and to consider whether a decrease in another line item could offset the increase.

Lastly, if after review there are any unmet needs that could not be covered with either alternative revenue sources (grants, fees, etc.) or cost efficiencies, please identify these for the Warrant Committee along with specific explanations for essentials whose higher costs make Warrant Committee guidance inconsistent with providing an appropriate level of service. The Warrant Committee asks that any significant requests that fall outside of the above guidance be identified and communicated early, since it may trigger a Prop 2 ½ override request at Town Meeting.

The Warrant Committee looks forward to discussing particulars with the Superintendent, Town Administrator, and budget makers to ensure that essential and important services are provided, and that the Town’s overall costs and tax rate are controlled as well as possible.

Capital Budget requests should be handled through the Capital Budget Committee process.

Timeline

December, 2023 – FY 25 budgets are due to Town Administrator and Superintendent

January, 2024- Budgets transmitted to School Committee, Select Board and Warrant Committee

December 2023 – February 2024 – Warrant Committee Liaison Member due diligence

January 16th and 30th, 2024– Warrant Committee budget review meetings with Town Departments

February 13, 2024 – Warrant Committee budget review meeting with School Department

As always, thank you for the hard work you undertake on behalf of Medfield taxpayers and the long-term future of the Town. We look forward to working with all policy and budget makers to produce an FY25 Budget that provides efficient, quality services to Town residents while continuing to be fiscally responsible with taxpayer revenue.

Sincerely,

Medfield Warrant Committee

Stephen Callahan (Co-Chair), Deborah Cartisser, Emily McCabe, Peter Michelson, Brent Nelson, Jillian Rafter, Peter Saladino, Bob Sliney (Co-Chair), Edward Vozzella

Attachment – FY 25 Budget Forecast

+++++++++++++++++++++++++++++++++++++++++++++++++++++

Comments Off on Warrant Committee FY 25 Budget Guidance

Posted in Budgets, Warrant Committee

This came today in my e-newletter from the Division of Local Services (DLS) at the Massachusetts Department of Revenue to explain what the Gov’s administration thinks are the highlights of her first budget.

| Partnering with our Cities and Towns – FY24 Funding Updates Secretary Matthew J. Gorzkowicz – Executive Office for Administration & Finance FY24 Budget On Wednesday, August 9, Governor Healey signed the FY24 budget, representing $55.98 billion in historic investments in schools, child care, workforce development, public transit, housing, climate resiliency and other key areas that will help make Massachusetts more affordable, competitive, and equitable. In collaboration with our partners in the Legislature, the budget includes hallmark proposals from Governor Healey, including making community college free for students aged 25 and older through MassReconnect, expanding Commonwealth Cares for Children (C3) grants for early education and care providers, increasing funding for Early College, Innovation Career Pathways, apprenticeships and other workforce development programs, and dedicating 1 percent of the budget to energy and the environment for the first time. Through the FY24 budget, the Healey-Driscoll Administration is reaffirming our commitment to the state’s partnership with cities and towns, making historic investments in Chapter 70 school aid, unrestricted government aid, and student transportation. This spending plan fully funds another year of the Student Opportunity Act and dedicates resources to help cities and towns redevelop and revitalize their downtowns. In total, cherry sheet aid to municipalities across the Commonwealth is increasing $648 million, or 8.4%, over FY23, totaling $8.37 billion. With this being the administration’s first budget, we are excited to share some of the details on our support for cities and towns. Unrestricted General Government Aid (UGGA) A cornerstone of the administration’s commitment to partnering with municipalities is the expansion of Unrestricted General Government Aid, supporting essential local government services, including public safety, public works, and economic development. In FY24, UGGA is increasing by $39 million, or 3.2%, over FY23, totaling $1.27 billion. Education: Fully Funding the Student Opportunity Act The administration is focused on ensuring that all students have access to a high-quality public education. In FY24, Chapter 70 aid is increasing by $594 million, or 9.9%, over FY23, totaling $6.59 billion. This represents full funding of the Student Opportunity Act, the largest nominal increase in the history of the program, and the largest percentage increase in more than two decades. The budget also funds major increases in school transportation reimbursement ($21.3 million, 20%) and rural school aid ($9.5 million, 173%). It includes full funding for Special Education Circuit Breaker. FY24 also includes funding to make universal school meals permanent, ensuring every student across the Commonwealth has access to healthy nutrition during the school day. For school buildings, the FY24 budget includes $50 million for the new Green School Works program, providing grants to school districts for clean energy infrastructure, $100 million in supplemental grants to mitigate cost increases at school construction projects previously funded by the MSBA and an increase in the MSBA’s statutory cap to $1.2 billion. Municipal Partnerships The FY24 budget also includes funding for critical partnership programs between municipalities and the state. Some examples include: Increasing payments in lieu of taxes (PILOT) for state-owned land by $6.5 M (14%). Increasing funding for public libraries by $3.8 million (12%). $100 million in supplemental aid for municipal road and bridges, funded by Fair Share surtax revenues. $16.3 million in funding for the Municipal Regionalization and Efficiencies Incentive Reserve, which funds programs including the Community Compact’s Best Practice ($2.1 million) and Efficiency and Regionalization Grant ($600,000) programs. $600,000 for the Massachusetts Downtown Initiative for municipalities looking to revitalize their downtowns. FY24-FY28 Capital Investment Plan On June 22, the Healey-Driscoll Administration released its first five-year Capital Investment Plan (CIP), outlining more than $14 billion in investments over five years to build a more affordable, competitive, and equitable future for Massachusetts. The investments in the FY24-FY28 CIP complement and build on the funding proposed in the administration’s inaugural operating budget, with a particular emphasis on advancing climate, economic development, and housing goals – including the creation of a new $97 million HousingWorks program. For municipalities, the CIP includes significant funding for transportation, economic development, climate initiatives, technology infrastructure, and more. Transportation FY24 investments in transportation infrastructure across our cities and towns include: $200 million for Chapter 90 local transportation projects $25 million for the Municipal Pavement Program $15 million for the Municipal Small Bridge Program $15 million for the Complete Streets Program $8.5 million for the Shared Streets and Spaces Program $6 million for the Local Bottleneck Reduction Program Economic Development The Healey-Driscoll Administration is committed to working with local leaders to build vibrant communities, revitalize downtowns, and create economic opportunity for all Massachusetts residents. In FY24, investments through the CIP include: $96 million for MassWorks infrastructure grants $16.6 million for Revitalizing Underutilized Properties $5 million for the Rural and Small Town Development Fund Climate Withstanding the climate crisis and protecting our environment requires a strong partnership between the state and local communities. The FY24 CIP continues investments in EEA’s programs that support communities as they plan for the future, including: $41.2 million for the Clean Water Trust Revolving Fund $23.7 million for the Municipal Vulnerability Program (MVP) $21 million for Community Investment Grants $12 million for Inland Dams and Seawalls $10 million for MassTrails grants to municipalities Technology Ensuring that all municipalities have the necessary technological infrastructure is critical for growth throughout Massachusetts. The FY24 CIP invests: $6.5 million for the Broadband Middle Mile Program $5 million for the Community Compact Municipal Fiber Grant Program $5 million for Community Compact Information Technology Grants $1 million for the Broadband Last Mile Program Other Municipal Funding $25 million for Library Construction Grants $10 million for Cultural Facilities Fund Grants $4 million for Municipal ADA Improvement Grants $1.6 million for Historic Preservation Grants We remain committed to working with our municipal partners in support of your efforts to make our Commonwealth stronger for all. Thank you for your dedication and hard work! For more information on the FY24 budget, please visit www.mass.gov/gaa. For more information on the FY24-FY28 Capital Investment Plan, please visit www.mass.gov/capital. Register Today for the 2023 “What’s New in Municipal Law” Seminars The Division of Local Services Municipal Finance Law Bureau will offer its annual “What’s New in Municipal Law” seminars for local officials on Thursday, September 21, 2023 at the Bentley University Conference Center in Waltham and Thursday, September 28, 2023 at the Log Cabin Banquet & Meeting House in Holyoke. The seminars will be held in-person and run from 9am to 3pm. The registration fee is $100. Payment must be received by Friday, September 15th. Event check-in opens at 8:15am. Lunch will be provided. To view the registration form, please click here. Any questions regarding the seminars should be directed to dlsregistration@dor.state.ma.us. Highly Recommended: Formal Financial Policies The DLS Financial Management Resource Bureau (FMRB) provides tailored consultative services to municipalities across the state. Articles in this series highlight a particular financial management best practice that we frequently recommend. The adoption of formal financial policies is a best practice that serves many important purposes. Among the most crucial of these is the directive guidance that fiscally prudent policies provide for achieving sound, long-term budgeting practices. Along with a capital improvement plan and long-range forecast, financial policies constitute one of the three key tools that DLS encourages all communities to employ to shape the development of annual budgets that are balanced and sustainable into the future.  At a basic level, a policy constitutes a high-level plan for achieving certain goals within a defined topic area. In municipal government, financial policies can be divided into two broad categories. Fiscal planning policies present a roadmap to guide short- and long-term budget decisions. When they are well-reasoned, such policies help mitigate the risk of developing any structural imbalances while also providing a framework for sustaining and enhancing services. As the other category, financial operations policies promote accountability and enhanced coordination of services by defining procedural objectives and the related responsibilities assigned to applicable municipal officials and employees. Financial policies should be understood as a foundational component of the government’s larger system of internal controls and are themselves a form of internal control of the directive variety. It is because of this vital function that credit rating agencies such as Moody’s and Standard & Poor’s look favorably upon the presence of strong formalized policies when determining a community’s bond rating, which has a significant impact on the cost of borrowing. The effort to research, discuss, write, review, and finally adopt policies can seem a daunting task. As a result, many communities, especially smaller towns, have only informal and often unwritten guidelines that might only be passed along in an ad hoc fashion as local officeholders enter and leave municipal service. Such municipalities have a more tenuous hold on institutional knowledge and are also liable to be relatively myopic or disjointed in the pursuit of their goals. Hence, a prime objective for adopting formal, written policies is to serve as an educational tool that can foster long-term consistency and continuity in operational and budgeting practices. Furthermore, enhanced transparency in fiscal governance can be achieved through policy adoption, and we encourage cities and towns to incorporate fiscal policy text into their budget documents and presentations. While remaining more flexible and easier to modify than bylaws and ordinances, policies should provide instructive guidance to steer officials and employees toward objectives. To assure effectiveness, city and town officials must be thoughtful and proactive in promoting policy awareness within the organization. We also recommend communities to periodically review and revise their policies to address evolving goals and circumstances. From the financial management reviews and other municipal project work that FMRB has done over the years, the bureau has identified a minimum set of core policies we believe every city or town should adopt to manage the most significant areas of budgetary and operational risk. These are listed in the table below.  FMRB has drafted 30+ policy manuals for cities and towns, each of which incorporates the above topics, as well as others desired by the client community. Any municipality that is conducting research to create or revise a policy manual may access them here. |

Comments Off on State explains Gov’s first budget

Posted in Budgets, Financial, Legislature, State