FY2017 Single-Family Residential Tax Bill Andrew Nelson, Supervisor, Bureau of Accounts (BOA) Tony Rassias, Deputy Director, BOA

The State Total single-family residential tax bill for FY2017 is $5,621, an increase of $202 or 3.7 percent from FY2016, according to data captured from 332 of the Commonwealth’s 351 cities and towns in the DLS Muncipal Databank.

In addition, the average value of a single-family residential home was $399,413, the highest value since the FY2008 average value of $403,705, which was set as values were starting to drop in the real estate market.

So far in FY2017, with 345 communities reporting valuation data to the Division of Local Services (DLS), single-family residential parcels statewide represent:

- 66% of all residential class property assessed values;

- 54% of all property assessed values;

- 64% of all residential class parcels; and

- 56% of all class parcels and articles of personal property

Analysis of data for this article is limited to single-family residential parcels, class code 101, and does not include condominiums, multifamily homes or apartment buildings.

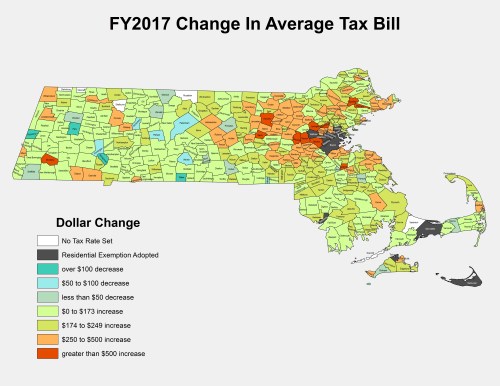

This analysis and all charts and graphs included with the exception of Chart 5 do not include communities for which a residential exemption was adopted in any fiscal year, but later in this article presents the impact on their average bill if the property was eligible for the exemption For FY2017 only, the analysis does not include data for six communities for which no tax rate has yet to be certified by the Bureau of Accounts.

This article begins with a review of the State Total single-family residential property tax bill, a calculation performed by DLS for many years. The article then continues with a review of the statewide median of community averages since FY2008 followed by community averages. The article then reviews how both the State Total and statewide median of community averages have fared over time relative to inflation and finally takes a special look at the residential exemption’s impact on the 13 communities that had it in FY2017.

The State Total

Calculation of the State Total presumes that Massachusetts is one local governmental entity for which such a bill would be determined. While not a median of all community averages, the State Total is presented and may be measured against itself from a prior fiscal year.

Chart 1 presents the calculation of the State Total from FY2008 to FY2017. Note that the State Total has annually increased over this period of time, yet not by more than 4%.

In addition, Chart 1 presents the average value for all single-family residential properties. The average value decreased from FY2008 to FY2013 by 12.2%, but from FY2013 to FY2017 increased 12.7%. Overall for the time period shown, the average value decreased by 1%.

Chart 1 |